DOWNLOAD MOBILE APPLICATION TO LEARN MORE: ECONOMICS QUESTIONS FOR SSC CHSL

DOWNLOAD MOBILE APPLICATION TO LEARN MORE: ECONOMICS QUESTIONS FOR SSC CHSL

DOWNLOAD MOBILE APPLICATION TO LEARN MORE: ECONOMICS QUESTIONS FOR SSC CHSL

Table of Contents

ECONOMICS QUESTIONS FOR SSC CHSL

This post contains the topic-wise notes of Indian Economy for SSC CHSL examination.

NATIONAL INCOME OF INDIA

National Income

National Income is the total value of a country’s final output of all new goods and services produced in one year. National Income is that total of all

➤ Wages and salaries, commissions and all labour incomes before payment of taxes and social security contributions.

➤ Interest income from bonds, mortgages loans etc after deducting interest paid on government debts.

➤ Rental income from real property and royalties.

➤ Profit of corporation, partnership before deduction of taxes based on income.

DOWNLOAD MOBILE APPLICATION TO LEARN MORE: ECONOMICS QUESTIONS FOR SSC CHSL

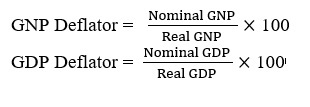

Gross Domestic Product (GDP)

Gross Domestic Product is the market value of the final goods and services produced within the domestic territory of a country during one year inclusive of depreciation.

GDPMP = Value of final goods and services produced within the territory of the country during a year.

Gross National Product (GNP)

Gross National Product is the market value of the final goods and services produced within the domestic territory of a country by the normal residents during an accounting year along with net factor income earned from abroad.

GNPMP = GDP MP + Net factor Income from Abroad

DOWNLOAD MOBILE APPLICATION TO LEARN MORE: ECONOMICS QUESTIONS FOR SSC CHSL

➤ Net Factor Income from abroad is the difference between factor income (rent, interest, profit and wages) earned by our residents from rest of the world and factor income earned by non-residents within our country.

Net factor income from abroad =

Factor income earned by residents of the country from abroad-Factor income earned by Non –residents in the country

DOWNLOAD MOBILE APPLICATION TO LEARN MORE: ECONOMICS QUESTIONS FOR SSC CHSL

Net National Product of Market Price (NNP MP)

NNP MP = Market value of final goods and services produced during a year + Net factor income from abroad – Depreciation or capital consumption

NNP MP = GNP MP – Depreciation

Net Domestic Product at Market Price (NDP MP)

Net Domestic product at market price is the market value of final goods and services produced by all the producers in the domestic territory of a country exclusive of depreciation during a year.

NDP MP = GDP MP – Depreciation

GDP MP = NDP + Depreciation

Net Domestic Product at Factor Cost (NDPFC)

Net Domestic Product of factor cost (NDPFC) is the total sum of factor incomes (rent + profit + wages + interest) generated within the domestic territory of a country during a year.

NDPFC = NDP MP – Net indirect Taxes

NDPFC = NDP MP + indirect Tax + Subsidy

DOWNLOAD MOBILE APPLICATION TO LEARN MORE: ECONOMICS QUESTIONS FOR SSC CHSL

Gross Domestic Product at Factor cost (GDPFC)

Gross Domestic Product at factor cost (GDPFC) is the total sum of factor incomes (rent + interest + profit + wages) generated within the domestic territory of a country, along with consumption of fixed capital during a year.

GDPFC = NDPFC + Depreciation

NDPFC = GDPFC – Depreciation

Net National Product at factor cost (NNPFC) Or National Income

Net National Product at factor cost (NNPFC) or National income is the total sum of factor incomes (rent + interest + profit + wages) generated within the domestic territory of a country, along with net factor income from abroad during a year.

DOWNLOAD MOBILE APPLICATION TO LEARN MORE: ECONOMICS QUESTIONS FOR SSC CHSL

NI = Rent + Wages + Salary + Interest + Profit

NNPFC = NDPFC + Net Factor income from abroad

Factor Price and Market Price

Suppose a company manufactured bicycle at ₹500 each. When the product (bicycle) delivered in market, Intermediaries Cost (Tax, Middleman,) has been added. The customer buy bicycle at ₹520 each. Hence the Factor Cost is ₹500 and Market Price is ₹520 each.

Private Income

Private income refers to that income which accrues to private sector from all sources, both within domestic territory as well as from rest of the world.

DOWNLOAD MOBILE APPLICATION TO LEARN MORE: ECONOMICS QUESTIONS FOR SSC CHSL

➤ It is the income of all private enterprises and households in the private sector from whatever source either earned or unearned.

Private Income =

Income earned by private sector in domestic product + Net factor income from Abroad + Current Transfer from government + Net current transfer from rest of the world + Interest on National Debts

Personal income

Personal income is the income actually received by the individuals and households from all sources in the form of factor income and current transfers.

➤ Personal income is always less than national income because factors of production do not get that income which is generated by them. Many deductions are made from national income and a few items are added for getting personal income.

Personal Income =

National Income – Corporate Tax – Undistributed Corporate Profits – Social securities contributions + Transfer payments

Personal Disposable Income

➤ Personal Disposable income means the actual income which can be spent on consumption by individuals and families. The whole of the personal income cannot be spent on consumption, because it is the income that accrues before direct taxes have actually been paid.

DOWNLOAD MOBILE APPLICATION TO LEARN MORE: ECONOMICS QUESTIONS FOR SSC CHSL

Disposable Income =

Personal Income – Direct Taxes

➤ The disposable income is divided consumption expenditure and savings.

Disposable Income = Consumption expenditure + Savings

National Disposable Income (NDI)

DOWNLOAD MOBILE APPLICATION TO LEARN MORE: ECONOMICS QUESTIONS FOR SSC CHSL

➤ National disposable income refers to disposable income of the country as a whole.

➤ It is estimated as the total sum of net domestic income at factor cost, net indirect taxes, net factor income from abroad and net current transfers from rest of the world.

National Disposable Income = National Income + Net Indirect tax + Net current transfer from rest of the world

Green GNP

➤ Green GNP denotes sustainable economic growth. GNP at constant prices or current prices does not take note of environment pollution and decay of natural resources.

➤ The increase in GNP with excessive use of natural resources and environmental pollution fails to denote sustainable economic development.

➤ Estimating GNP with parameters like excessive use of natural resources and environmental pollution is called ‘Green GNP’.

DOWNLOAD MOBILE APPLICATION TO LEARN MORE: ECONOMICS QUESTIONS FOR SSC CHSL

Per Capita Income

The average income of the people of a country in a particular year is called per capita income of that year. This concept also refers to the measurement of income at current prices at constant prices.

Methods of Measuring National Income

There are three methods of measuring National Income–

DOWNLOAD MOBILE APPLICATION TO LEARN MORE: ECONOMICS QUESTIONS FOR SSC CHSL

1. Product Method: According to this method, the total value of final goods and services produced in a country during a year is calculated at market prices.

To find out the GNP, the data of all productive received from forests, mineral received from mines, commodities produced by industries, the contributions to production made by transport, communications, insurance companies, lawyers, doctors, teachers etc are collected and assessed at market prices. Only the final goods and services are included and the intermediary goods and services are left out.

DOWNLOAD MOBILE APPLICATION TO LEARN MORE: ECONOMICS QUESTIONS FOR SSC CHSL

2. Income Method: According to this method, the net income payments received by all citizens of a country in a particular year are added up, i.e net incomes that accrue to all factors of production by way of net rents, net wages, net interest and net profits are all added together but incomes received in the form of transfer payments are not included in it.

3. Expenditure Method: According to this method, the total expenditure incurred by the society in a particular year is added together and includes personal consumption expenditure. Net domestic investment, government expenditure on goods and services and net foreign investment. This concept is based on the assumption that national income equals national expenditure.

National Income Estimation in Pre-independence Period

| Year | Per Capita | |

| Dada bhai Naoroji | 1868 | 20 |

| William Digby | 1899 | |

| Findlay Shirras | 1911, 1922, 1931 | 49 |

| Shah and Khambatta | 1921 | |

| V.K.R.V. Rao | 1925-29 1931-32 | 76 |

| R.C. Desai | 1931-40 |

DOWNLOAD MOBILE APPLICATION TO LEARN MORE: ECONOMICS QUESTIONS FOR SSC CHSL

Hindu Rate of Growth

➤ The term ‘Hindu rate of growth was coined by professor Rajkrishna, an Indian economist, in 1978

to characterise the slow growth.

➤ It explained against the backdrop of socialistic economic policies.

➤ It was coined to refer to the phenomenon of sluggishness in growth rate of Indian economy (3.5% observed persistently during 1950s through 1980s).

DOWNLOAD MOBILE APPLICATION TO LEARN MORE: ECONOMICS QUESTIONS FOR SSC CHSL

National Income estimation in India

➤ During pre independence era, no specific attempts were made for estimating national income in India.

➤ In 1868, the first attempt was made by Dada bhai Naoroji; He (in his book Poverty and Un-British rule in India) estimated Indian per capita annual income at a level of ₹20.

➤ After independence, the government of India appointed the national income committee in August 1949 under the chairmanship of Prof P.C Mahalanobis, to compile authoritative estimates of national income. The committee submitted its first report in 1951 and the final report in 1954.

➤ According to this report, the total national income of the country was estimated at a level of ₹8,650 crore and per capita income at a level of ₹246.90. The final report appeared in 1954 gave estimates of national income during the period of 1950 to 1954.

➤ For further estimation of national income, the government established Central Statistical Organization (CSO) which now regularly publishes National Income Data.

➤ Recently CSO has introduced a new Series on National income with 2011-12 as base year.

➤ National income includes the contribution of three sectors of the economy

DOWNLOAD MOBILE APPLICATION TO LEARN MORE: ECONOMICS QUESTIONS FOR SSC CHSL

(a) Primary sector (Agriculture, Forest, Fisheries, Mining)

(b) Secondary sector (Industries-Manufacturing & construction)

(c) Tertiary sector (Trade, Transport, Communications, Banking, insurance, Real estate, community and personal services)

DOWNLOAD MOBILE APPLICATION TO LEARN MORE: ECONOMICS QUESTIONS FOR SSC CHSL

Important Fact

➤ In India, National income is estimated by central statistical organization.

➤ Recently, the base year for computation of National income is 2011-12.

➤ Hindu Rate of growth is associated with per capita income.

➤ Hindu rate of growth refers to the rate of growth of GDP.

➤ As the Indian economy develops, the share of the tertiary sector in the GDP increases.

➤ Bhutan has adopted Gross National Happiness as an index of the well being of its citizens.

➤ The most appropriate measure of a country’s economic growth is its per capita real income.

➤ Per capita income of a country is derived from National income and population both.’

➤ Tertiary sector contributes largest Gross National Product in Indian economy.

➤ Simon Kuznets was a generator of National Income Accounting. He received a Nobel Prize in 1971 for his empirical work on Economic growth.

➤ National income is mainly based on two concept National Product and Domestic product.

DOWNLOAD MOBILE APPLICATION TO LEARN MORE: ECONOMICS QUESTIONS FOR SSC CHSL

PLANNING IN INDIA

History of Planning in India

• First attempt to initiate economic planning in India was made by Sir M Vishveshvarayya, a noted engineer and politician, in 1934 through his book ‘Planned Economy for India’.

• In 1938. National Planning Commission’ was set-up under the chairmanship of Jawahar Lal Nehru by the Indian National Congress. Its recommendations could not be implemented because of the beginning of the World War II and changes in the Indian political situation.

• In 1944, ‘Bombay Plan’ was presented by 8 leading industrialists of Bombay. It was drafted by GD Birla and JRD Tata.

• In 1944, ‘Gandhian Plan’ was given by Sarojini Naidu Agarwal.

• In 1945, ‘People’s Plan’ was given by MN Roy.

• In 1950, ‘Sarvodaya Plan’ was given by JP Narayan. A few points of this plan were accepted by the government.

DOWNLOAD MOBILE APPLICATION TO LEARN MORE: ECONOMICS QUESTIONS FOR SSC CHSL

The Planning Commission.

• The Planning Commission was set-up on 15th March 1950 under the chairmanship of Jawahar lal Nehru, by a resolution of Union Cabinet .

• It is an extra-constitutional and non-statutory body.

• It consists of Prime Minister as the ex-officio Chairman, one Deputy Chairman appointed by the Prime Minister and some full time members.

• The tenure of its members and Deputy Chairman is not fixed. They are appointed by the government on its own discretion. The number of members can also change according to the wishes of the government.

DOWNLOAD MOBILE APPLICATION TO LEARN MORE: ECONOMICS QUESTIONS FOR SSC CHSL

Functions

• Assessment of material, capital and human resources of the country.

• Formulation of plans for the most effective and balanced utilisation of country’s resources.

• To determine the various stages of planning and to propose the allocation of resources on the priority basis. To act as an advisory body to the Union Government

• To evaluate from time-to-time the progress achieved in every stage of the plan and also to suggest remedial measures.

• To advise the Centre and the State Governments from time-to-time on special matters referred to the commission.

• Planning in India drew on Economic plane of lenin.

DOWNLOAD MOBILE APPLICATION TO LEARN MORE: ECONOMICS QUESTIONS FOR SSC CHSL

National Development Council

• All the plans made by the Planning Commission have to be approved by National Development Council (NDC) first. It was constituted to build co-operation between the states and the Planning Commission for economic planning.

• It is an extra-constitutional and extra-legal body

• It was set-up on 6th August 1952 by a proposal of the government, the PM is the ex-officio chairman of NDC. Other members. are Union Cabinet Ministers, Chief Ministers and Finance Ministers of all states, Lt Governors of Union Territories and Governors of Centrally-ruled States.

Five Year Plans

First Five Year Plan (1951-56)

• It was based on Harrod-Domar Model.

• Community Development Programme was launched in 1952. Two-fold objectives were there.

• Its objective was to correct the disequilibrium in the economy caused by 3 main problems

(i). influx of refugees,

(ii), severe food shortage

(iii). mounting inflation.

DOWNLOAD MOBILE APPLICATION TO LEARN MORE: ECONOMICS QUESTIONS FOR SSC CHSL

• Targeted growth rate was 2.1% and achieved rate was 3.6%. .

• Only plan to see prices declining. .

• To initiate a process of all-round balanced development to ensure a rising national income and a steady improvement in living standards.

• Emphasised on agriculture, price stability, power and transport.

• It was more than a success, because of good harvests in the last two years.

Second Five Year Plan (1956-61)

• Achieved 4.1% as against a targeted growth rate of 4.5 %.

• Durgapur, Bhilai and Rourkela steel plants were founded.

• Also called as Mahalanobis Plan after its chief architect PC Mahalanobis.

• Its emphasis was on economic stability. Agriculture target fixed in the first plan was almost achieved. Consequently, the agriculture sector got low priority in the second-five year plan.

• Its objective was Rapid Industrilisation, particularly basic and heavy industries such as iron and steel, heavy chemicals like nitrogenous fertilizers, heavy engineering and machine building industry.

• Besides, the Industrial Policy of 1956 emphasized the role of Public Sector and accepted the establishment of a socialistic pattern of the society as the goal of economic policy.

• Advocated huge imports which led to emptying of funds leading to foreign loans. It shifted basic emphasis from agriculture to industry far too soon. During this plan, price level increased by 30%, against a decline of 13% during the First Plan.

DOWNLOAD MOBILE APPLICATION TO LEARN MORE: ECONOMICS QUESTIONS FOR SSC CHSL

Third Five Year Plan (1961-66)

•Targeted growth rate (5.6 %) could not be achieved as GDP grew by 2.8% only.

• Third Five Year plan is also called Gadgil Yojana.

• At its conception time, it was felt that Indian economy has entered a take-off stage. Therefore, its aim was to make India a “self-reliant’ and self-generating’ economy.

• Also, it was realised from the experience of first two plans that agriculture should be given the top priority to suffix the requirements of export and industry.

• The other objectives of the plan included the expansion of basic industries, optimum utilization of country’s labour power and reducing the inequalities of income and wealth.

• Relied heavily on foreign aid (IMF).

• Complete failure due to unforeseen misfortunes, viz. Chinese aggression (1962). Indo-Pak War (1965), severest drought (1965-66).

• Prices increased by 36% in five years.

• Hence, third plan failed in every respect.

DOWNLOAD MOBILE APPLICATION TO LEARN MORE: ECONOMICS QUESTIONS FOR SSC CHSL

Third Annual Plans (1966-69)

• Plan holiday for 3 years.

• The prevailing crisis in agriculture and serious food shortage necessitated the emphasis on agriculture during the Annual Plans

• During these plans a whole new agricultural strategy involving wide-spread distribution of High-Yielding Varieties (HYVS) of seeds, the extensive use of fertilisers, exploitation of irrigation potential and soil conservation was put into action to tide-over the crisis in agricultural production

• During the Annual Plans, the economy basically absorbed i the shocks given during the Third Plan, making way for a planned growth

DOWNLOAD MOBILE APPLICATION TO LEARN MORE: ECONOMICS QUESTIONS FOR SSC CHSL

Fourth Five Year Plan (1969-74)

• The fourth plan set before the two principal objectives-growths with stability and progress towards self-reliance

• Main emphasis an agricultural growth rate targeted 5.6 % but achieved 3.3 % growth rate only.

• Fared well in the first two years with record production, last three years failure because of poor monsoon.

• Had to tackle the influx of Bangladeshi refugees before and after 1971 Indo-Pak War

• During the planning period, prices increased by about 61%

• Nationalisation of 14 Banks and the Green Revolution began.

Fifth Five Year Plan (1974-79)

• It targeted a growth rate of 4.4% but achieved a growth rate of 4.8 %.

• Original approach (by subramanium) proposed complementing economic growth with direct attack on poverty.

• But it was replaced later with objectives of removal of poverty and getting self-reliance (by DP Dhar).

• The Fifth Plan prepared and launched by DD Dhar. He proposed to achieve two main objectives viz, ‘Removal of Poverty (Garibi Hatao) and Attainment of Self-reliance’, through promotion of high rate of growth, better distribution of income and a very significant growth in the domestic rate of savings.

• National programme of minimum needs was initiated in which primary education, drinking water, medical facilities in rural areas, nourishing food, land for the houses of landless labourers, rural roads, electrification of the villages and cleanliness of the dirty suburbs were included.

• The plan was terminated in 1978 (instead of 1979) when Janta Government came to power.

DOWNLOAD MOBILE APPLICATION TO LEARN MORE: ECONOMICS QUESTIONS FOR SSC CHSL

Rolling Plan (1978-80)

• The concept of rolling plan was given by Gunnar Myrdall.

• It meant that expenditures budgeted but unspent at the end of year would be carried over to the next year.

• There were 2 sixth-five Plans-one by Janta Government (for 78-83) which was in operation for 2 years only and the other by the Congress Government when it returned to power in 1980.

• The Janta Government Plan is also called Rolling Plan.

• The focus of the plan was enlargement of the employment potential in agriculture and allied activities, encouragement to household and small industries producing consumer goods for consumption and to raise the incomes of the lowest income classes through minimum needs programme.

Sixth Five Year Plan (1980-85)

• Sixth Five Plan targeted 5.2% but achieved a growth rate of 5.7%

• First plan with signs of starting of economic liberalisation. Basic objective was removal of poverty through direct action

• Integrated Rural Development Programme (IRDP). Minimum Needs Programme (MNP) were started.

• Objectives Include Increase in National income, modernisation of technology, ensuring continuous decrease in poverty and unemployment, population control through family planning, etc.

Seventh Five Year Plan (1985-90)

• The Seventh Plan emphasized policies and programmes, which aimed at rapid growth in food-grains production. increased employment opportunities and productivity within the framework of basic tenants of planning.

• It was a great success, the economy recorded 6% growth rate against the targeted 5%. Indian economy finally broke the Hindu growth rate barrier.

Due to severe economic crisis, eighth-five year plan was delayed by two years. The intervening years (1990-91 and 1991-92) were declared Annual Plans.

DOWNLOAD MOBILE APPLICATION TO LEARN MORE: ECONOMICS QUESTIONS FOR SSC CHSL

Eighth Five Year Plan (1992-97)

• First Five Year Plan based on Rao and Manmohan mode of economic growth.

• Sought to gradually open the Indian economy through LPG Liberalisation, privatisation and Globalisation measures.

• Some of the main economic performances during Eighth Plan period were rapid economic growth, high growth of agriculture and allied sector and manufacturing sector, growth in exports and imports, improvement in trade and current account deficit.

• The most notable feature of the Eighth Plan period was that the GDP grew at an average rate of 6.8% exceeding the target growth rate of 5.6 %

DOWNLOAD MOBILE APPLICATION TO LEARN MORE: ECONOMICS QUESTIONS FOR SSC CHSL

Ninth Five Year Plan (1997-2002)

• Growth rate of GDP during the plan was 5.4% per annum as against the target of 6.5%

• Agriculture grew by 2.1% as against the target of annum. 4.2% per annum.

• Industrial growth was 4.5% as against the target of 3% per annum.

• Exports grew by 7.4\% (target was 14.55\%) and imports grew by 6.6% (target was 12.2% per annum.).

• Services grew at the rate of 7.8% per annum.

DOWNLOAD MOBILE APPLICATION TO LEARN MORE: ECONOMICS QUESTIONS FOR SSC CHSL

Tenth Five Year Plan (2002-2007)

Objectives

(i) To attain a growth rate of 8%

(ii) Reduction of poverty ratio to 20% by 2007 and to 10% by 2012.

• Providing gainful high quality employment to the addition to the labour force over the Tenth Plan period.

• Universal access to primary education by 2007.

• Reduction in gender gaps in literacy and wage rates by atleast 50% by 2007.

• Reduction in decadal rate of population growth between 2001 and 2011 to 16.2 %.

• Increase in literacy rate to 72% within the plan period and to 80% by 2012

• Reduction of Infant Mortality Rate (IMR) to 45 per 1000 live births by 2007 and to 28 by 2012.

• Reduction of Maternal Mortality Rate (MMR) to 20 per 1000 live births by 2007 and to 10 by 2012

• Increase in forest and tree cover to 25% by 2007 and 33% by 2012.

• All villages to have sustained access to potable drinking water by 2012.

• Cleaning of all major polluted rivers by 2007 and other notified stretches by 2012.

• The tenth plan focused on ways and means of correcting the regional imbalance.

• The plan laid great emphasis on agriculture since growth in this sector is likely to lead to the widest dissemination of benefits, especially to the rural poor including agricultural labour.

• The growth strategy of the Tenth Plan sought to ensure the rapid growth of those sectors which are most likely to create high quality employment opportunities, which included such sectors as construction, real estate and housing, transport, small scale industries, modern retailing, entertainment, IT-enabled services, etc.

• The tenth-five year plan achieved a growth rate of 7.6% below the targeted 8% but higher than all Previous Five Year Plans.

DOWNLOAD MOBILE APPLICATION TO LEARN MORE: ECONOMICS QUESTIONS FOR SSC CHSL

Eleventh Five Year Plan (2007-2012)

Monitorable Socio-Economic Targets of the Eleventh Plan

Income and Poverty

• Accelerate growth rate of GDP from 8% to 10% and then maintain at 10% in the 12th Plan in order to double per capita income by 2016-17.

• Increase agricultural GDP growth rate to 4% per year to ensure a broader spread of benefits.

• Create 70 million new work opportunities.

• Reduce educated unemployment to below 5%.

• Raise real wage rate of unskilled workers by 20%.

• Reduce the headcount ratio of consumption poverty by 10% points.

DOWNLOAD MOBILE APPLICATION TO LEARN MORE: ECONOMICS QUESTIONS FOR SSC CHSL

Education

• Reduce dropout rates of children from elementary school from 52.2% in 2003-04 to 20% by 2011-12. • Increase literacy rate for persons of age 7 years or more to 85%.

• Lower gender gap in literacy to 10% points.

• Increase the percentage of each cohort going to higher education from the present 10% to 15% by the end of the Eleventh Plan.

Health

• Reduce Infant Mortality Rate (IMR) to 28 and Maternal Mortality Ratio (MMR) to I per 1000 live births.

• Reduce total fertility rate to 2.1.

• Reduce malnutrition among children of age group 0-3 to half its present level.

• Reduce aneamia among women and girls by 50% by the end of the Eleventh Plan.

Women and Children

• Raise the sex ratio for age group 0-6 to 935 by 2011-12 and to 950 by 2016-17.

• Ensure that at least 33% of the direct and indirect beneficiaries of all government schemes are women and girl children.

Infrastructure

• Ensure electricity connection to all villages and BPL households by 2009 and round-the-clock power by the end of the plan.

• Ensure all-weather road connection to all habitation with population 1000 and above (500 in hilly and tribal areas) by 2009, and ensure coverage of all significant habitation by 2015.

• Provide homestead sites to all by 2012 and step up the pace of house construction for rural poor to cover all the poor by 2016-17.

DOWNLOAD MOBILE APPLICATION TO LEARN MORE: ECONOMICS QUESTIONS FOR SSC CHSL

Twelfth Five Year Plan (2012-17)

• The approach paper to the plan is based on the theme “faster, sustainable and more inclusive growth,”

• The paper indicates 14 key areas to be focussed by the twelfth-five year plan. Some of these are energy transport, natural resources, rural transformation, health, transport, education and skill development.

Key Targets

(i) Real GDP growth rate-8 % (down from earlier 8.2%).

(ii) Agricultural growth rate-4%.

(iii) Manufacturing Growth rate-10%.

(iv) Consumption poverty-to be reduced by 10 % points.

(v) Employment-50 million new work opportunities in the non-farm sector,

(vi) Mean years of schooling-Increase it to 7 years by 2017.

(vii) Infant Mortality Rate (IMR)- Reduce to 25.

(viii) Maternal Mortality Rate (MMR)-Reduce to 1 per 1000 live births.

(ix) Child (0-6) sex ratio-Raise it to 950 by 2017.

(x) Total fertility rate-Reduce it to 2.1.

(xi) Gross Irrigated Area-Increase it from 90 million hectare to 103 million hectare by 2017.

(xii) Renewable energy capacity-Add 30000 MW of new power capacity.

DOWNLOAD MOBILE APPLICATION TO LEARN MORE: ECONOMICS QUESTIONS FOR SSC CHSL

Rural and Urban Poverty Inclusive Development

• Inclusive development means development which is participative and empowers every individual especially the poor and excluded.

• Inclusive development in India first emphasised in the Eleventh Plan Period (2007-12).

• The essential elements of inclusive development are

(i) poverty reduction and increase in quantity and quality of employment

(ii) agricultural development

(iii) reduction in regional disparities

(iv) social sector development

(v) protecting the environment.

Human Development

• The Human Development Report (HDR) was published by the UNDP since 1990 captures the essence of Human development,

• The concept of HDR was started by Pakistani economist Mahbub-ul-Haq and Amartya Sen.

• The theme of the HDR-2013 is the rise of the South: Human Progress in a Diverse World.

POVERTY AND UNEMPLOYMENT

Poverty is a social phenomenon in which a section of society is unable to fulfill even its basic necessities of life. When a substantial segment of a society is deprived to the minimum level of living and continues at a bare subsistence level, that society is said to be plagued with mass poverty

➤ Poverty emphasizes minimum level of living rather than a reasonable level of living

Types of poverty

DOWNLOAD MOBILE APPLICATION TO LEARN MORE: ECONOMICS QUESTIONS FOR SSC CHSL

➤ Two types of poverty-Relative and Absolute.

Absolute Poverty: In absolute standard, minimum physical quantities of cereals, pulses, milk, butter etc are determined for a subsistence level and then the price quotations convert into monetary terms of the physical quantities. Aggregating all the quantities included, a figure expressing per capita consumer expenditure is determined.

➤ The population whose level of income is below the figure is considered to be below the poverty line.

Relative Poverty: Income distribution of the population in different fractile group is estimated and a comparison of the levels of living to the top 5-10% with the bottom 5-10% of the population reflects the relative standards of poverty.

Poverty line in India

India consist about one-third of poor people in the world. Estimation of poverty has been a contentious issue in India. Historically, first estimation of poverty was done by Dadabhai Naoroji in 19th century, though he himself did not use the word “Poverty Line”.

Dadabhai Naoroji

➤ The history of poverty estimation in India goes back to 19th century when Dadabhai Naoroji effort and careful study led him to conclude subsistence based poverty line at 1867-68 prices, though he never used the word “poverty line”.

➤ It was based on the cost of a subsistence diet consisting of rice, flour, pulse, mutton, vegetables, ghee and salt.

➤ According to him subsistence was what is necessary for the bare wants of a human being, to keep him in ordinary good health and decency.

➤ He concluded the subsistence costs based poverty line that varied from 16 to 35 per capita per al year in various regions of India.

DOWNLOAD MOBILE APPLICATION TO LEARN MORE: ECONOMICS QUESTIONS FOR SSC CHSL

National Planning Committee

➤ In 1938, congress president Subhash Chandra Bose set up the National Planning Committee (NPC) with Jawaharlal Nehru as chairman and professor K.T. Shah as secretary for the purpose of drawing up an economic plan with the fundamental aim 01 to ensure an adequate standard of living for the masses.

➤ The committee regarded the irreducible minimum income between 15 to 25 per capita per month at per war prices. However this was also not tagged something as a poverty line of the country.

Ojha’s Estimate of Poverty

Mr. P.D. Ojha estimated the number of persons below the poverty line on the basis of average calorie intake of 2,250 per capita per day in 1960-61 and 1967-68.

➤ Due to comparison, only 52% of the rural population in 1960-61, 70% of the population in 1967-68 was found to be below the poverty level.

Dandekar and Rath’s study of poverty in India

➤ Dandekar and Rath estimated that lower minimum for rural population 180 per capita per annum and a somewhat higher minimum 270 per capita per annum for the urban population at 1960-61 prices.

➤ According to 1968-69 prices, the corresponding figures for the rural and urban population work out to be 324 and 486 per capita per annum respectively.

➤ Dandekar and Rath estimated that in 1968-69 about 40% of the rural population and a little more than 50% of the urban population lived below the poverty line.

DOWNLOAD MOBILE APPLICATION TO LEARN MORE: ECONOMICS QUESTIONS FOR SSC CHSL

First Planning Commission Working Group

➤ The concept of the poverty line was first introduced by a working group of the planning commission in 1962 and subsequently expanded in 1979 by a task force.

➤ In 1962, working group recommended that the national minimum for each household of five persons should be not less than 100 per month for rural and 125 for urban at 1960-61 prices.

➤ These estimates excluded the expenditure on health and education, which both were expected

to be provided by the state.

DOWNLOAD MOBILE APPLICATION TO LEARN MORE: ECONOMICS QUESTIONS FOR SSC CHSL

Y.K. Alagh Committee

Till 1979, the approach to estimate poverty was traditional i.e. lack of income. It was later decided to measure poverty precisely as starvation i.e. in terms of how much people eat.

➤ This approach was first of all adopted by the YKAlagh committee’s recommendation in 1979 where by the people consuming less than 2100 calories in the urban areas or less than 2400 calories in the rural areas are poor.

➤ Y.K Alagh eventually defined the first poverty line in India.

Lakdawala Formula

➤ Till recently as 2011, the official poverty lines were based entirely on the recommendations of the Lakdawala committee of 1993.

➤ This committee defined poverty line on the basis of household per capita consumption expenditure. The committee used CPI-IL (Consumer price index for industriallabours) and CPI-AL (Consumer Price Index for Agricultural laboures) for estimation of the poverty line.

➤ The method of calculating poverty included first estimating the per capita household expenditure at which the average energy norm is met and then his with that expenditure as the poverty line defining as poor as all persons who live in households with per capita expenditures below the estimated value.

➤ The fallout of the Lakdawala formula was that number of people below the poverty line got almost double. The number of people below the poverty line was 16% of the population in 1993-94. Under the Lakdawala calculation, it became 36.3%.

DOWNLOAD MOBILE APPLICATION TO LEARN MORE: ECONOMICS QUESTIONS FOR SSC CHSL

Suresh Tendulkar Committee

➤ In 2005, Suresh Tendulkar Committee constituted by the planning commission.

This committee recommended to shift away from was the calorie based model and made the poverty line somewhat broad based by considering monthly spending on education health, electricity and transport.

➤ Strongly recommended target nutritional outcomes i.e., instead of calories, intake nutrition to support should be counted.

➤ It suggested that a uniform poverty basket line be used for rural and urban region.

➤ It recommended a change in the way prices are adjusted and demanded for an explicit provision an in the poverty basket line to account for private expenditure in health and education.

➤ Tendulkar adopted the cost of living as the basis for identifying poverty.

DOWNLOAD MOBILE APPLICATION TO LEARN MORE: ECONOMICS QUESTIONS FOR SSC CHSL

Task Force for Identification of Poor

➤ A task force headed by NITI Aayog vice chairman Arvind Panagariya will soon come up with a new methodology to estimate the number of poor in the country.

➤ The 14 member task force will develop a working definition of poverty and prepare a road-map for its elimination.

DOWNLOAD MOBILE APPLICATION TO LEARN MORE: ECONOMICS QUESTIONS FOR SSC CHSL

| Population below poverty line | Rural Poverty | Urban Poverty | Total Poverty |

| Less than 10 | Goa, Punjab, Himachal Pradesh, Kerala, Sikkim | Goa, Sikkim, Himachal Pradesh, J & K, Mizoram, Kerala, Andhra Pradesh Maharashtra, Punjab, Tripura | Goa, Kerala, Himachal Pradesh, Sikkim, Punjab, Andhra Pradesh |

| 10-20 | Andhra Pradesh, Haryana Meghalaya, Rajasthan, J&K, Nagaland, Tripura, Tamil Nadu, Uttarakhand | Gujarat, Haryana, Uttarakhand, Rajasthan, West Bengal, Karnataka, Nagaland, Odisha | J&K, Haryana, Nagaland, Uttarakhand, Tamil Nadu, Meghalaya, Tripura, Rajasthan, Gujarat, Maharashtra, West Bengal |

| 20-30 | Gujarat, West Bengal, Maharashtra, Karnataka | Arunachal Pradesh, Assam, Madhya Pradesh, Chhattisgarh, Jharkhand, Uttar Pradesh | Mizoram, Karnataka, Uttar Pradesh |

| 30-40 | Arunachal Pradesh, Manipur, Madhya Pradesh, Assam, Uttar Pradesh, Bihar, Odisha, Mizoram | Bihar, Manipur | Madhya Pradesh, Assam, Odisha, Bihar, Arunachal Pradesh, Manipur, Jharkhand, Chhattisgarh |

| Above 40 | Jharkhand, Chhattisgarh |

Rural Poverty

Causes for Rural poverty are as follows:

➤ Rapid population growth

➤ Lack of capital

➤ Lack of alternate employment opportunities other than agriculture.

➤ Excessive population pressure on agriculture

➤ Illiteracy

➤ Regional disparities

➤ Joint family system

➤ Lack of proper implementation of distribution system.

➤ Indifferent attitude towards investment

➤ Child marriage tradition

DOWNLOAD MOBILE APPLICATION TO LEARN MORE: ECONOMICS QUESTIONS FOR SSC CHSL

Urban Poverty

Causes for urban poverty are as follows:

➤ Rapid increase in population

➤ Limited job opportunities of employment in India

➤ No proper implementation of public distribution system

➤ Migration of rural youth towards cities

➤ Lack of housing facilities

➤ Lack of vocational education/training.

DOWNLOAD MOBILE APPLICATION TO LEARN MORE: ECONOMICS QUESTIONS FOR SSC CHSL

Government Efforts for Eliminating Rural Poverty

➤ Legal abolition of Bonded Labourers

➤ Preventing the Centralization of Wealth Modifying the Law

➤ Antyodaya Plan

➤ Small Farmer Development Programme

➤ Drought Area Development Programme

➤ Twenty Point Programme

➤ Food for Work Programme

➤ Minimum Needs Programme (MNP)

➤ Integrated Rural Development Programme

➤ National Rural Employment Programme Rural Labour Employment Guarantee Programme

➤ Jawahar Gram Samriddhi Yojana (JGSY)

➤ TRYSEM Scheme

➤ Family Planning/Welfare Programme for Population Control

➤ Employment Assurance Scheme for Rural Artisans

➤ DWCRA Programme Swarna Jayanti Gram Swarozgar Yojana

➤ Mahila Samriddhi Yojana

➤ National Assistance Programme

➤ Group Life Insurance Scheme for Rural Areas

➤ Rural Housing Programme

➤ Pradhan Mantri Gramodaya Yojana

➤ Swarna Jayanti Gram Swarojgar Yojana

➤ Sampurna Gramin Rojgar Yojana

➤ Indira Awas Yojana

➤ Samagra Awas Yojana

➤ Agriculture Income Insurance Scheme

➤ MGNREGA

➤ National Rural Livelihood Mission

DOWNLOAD MOBILE APPLICATION TO LEARN MORE: ECONOMICS QUESTIONS FOR SSC CHSL

Government Efforts for Eliminating Urban Poverty

➤ Nehru Rozgar Yojana

➤ Emphasis on Vocational Education

➤ Self Employment Programme for the Urban Poor

➤ Financial Assistance for Constructing Houses

➤ Self-Employment to the Educated Urban Youth Programme

➤ Prime Minister Rozgar Yojana

➤ National Social Assistance Programme

➤ Urban Basic Services for the Poor Programme

➤ National Urban Livelihood Mission

➤ Swarna Jayanti Shari Rozgar Yojana

➤ Prime Minister Integrated Urban Eradication Programme

Multidimensional Poverty

Multidimensional poverty assessments aim to measure the non-income based dimensions of poverty, to provide a more comprehensive assessment of the extent of poverty and deprivation.

➤ The multinational poverty index (MPI) is published by the UNDP’S Human Development Report office and tracks deprivation across three dimensions and 10 indicators

(a) Health (child Mortality, Nutrition)

(b) Education (years of schooling, Enrollment)

(c) Living standard (Water, sanitation,Electricity, cooking fuel, floor, assets

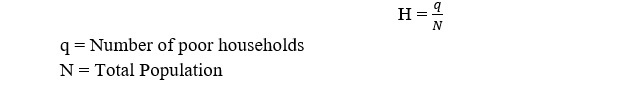

Head Count Ratio

National Poverty headcount ratio is the percentage of the population living below the national poverty lines. National estimates are based on population weighted subgroup estimates from household surveys.

DOWNLOAD MOBILE APPLICATION TO LEARN MORE: ECONOMICS QUESTIONS FOR SSC CHSL

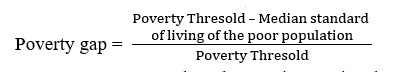

Poverty Gap

Poverty Gap is an indicator used to assess the extent to which the standard of living of the poor population is under the poverty line.

➤ Poverty measures based on an international poverty line attempt to hold real value of the poverty line constant across countries, as is done when comparison overtime. The poverty line is based on the conversion of the $1.25 a day international poverty line into respective national currency units.

DOWNLOAD MOBILE APPLICATION TO LEARN MORE: ECONOMICS QUESTIONS FOR SSC CHSL

Lorenz Curve

➤ The Lorenz curve is used in economics and ecology to describe inequality in wealth or size. The Lorenz curve is a function of the cumulative proportion of ordered individuals mapped into the on corresponding cumulative proportion of their size.

➤ If all individuals are the same size, the Lorenz curve is a straight diagonal line, called the line of equality.

➤ If inequality in individual size exist, then the Lorenz curve falls below the line of equality. The total amount of inequality can be summarized by the Gini coefficient.

Unemployment

J.M. Keynes diagnosed unemployment developed economies to be the result of a deficiency in effective demand, It implied that in such economies industries get closed and demand for labour falls because the demand for the products in industry is no longer there.

➤ According to J.M. Keynes such employment can be removed from the economy by increasing effective demand which in turn will increase labour demand to give motion to the machines in the economy.

➤ In broad sense a state of unemployment appears when a labour does not obtain employment opportunity despite his willingness to work on existing wage rate.

➤ India is a developing economy where unemployment situation arises due to different reasons. These economies also face the problem of inflation side by side with the problem of unemployment.

DOWNLOAD MOBILE APPLICATION TO LEARN MORE: ECONOMICS QUESTIONS FOR SSC CHSL

Types of unemployment in India:

1. Under Employment: Those labourers are under employed who obtain work but their efficiency and capability are not utilized at their optimum and as a result they contribute in the production up to a limited level.

➤ A country having this type of unemployment fails to exploit the efficiency of their labourers.

2. Structural Unemployment: This type of unemployment is associated with economic structure of the country. When demand for labour falls short to the supply of labour due to rapidly growing population and their immobility, the problem of unemployment appears in the economy.

➤ Besides due to growing population, rate of capital formation falls down which again limits the employment opportunities. This type of structural unemployment is of long run in nature.

➤ Indian unemployment is basically related to this category of unemployment.

3. Open unemployment: When the labourers live without any work and they don’t find any work to do, they come under the category of open unemployment.

➤ Educated and unskilled labour unemployment are included in open unemployment.

For example:

The migration from rural to urban areas in search of work is very often found in India.

DOWNLOAD MOBILE APPLICATION TO LEARN MORE: ECONOMICS QUESTIONS FOR SSC CHSL

4. Seasonal unemployment:

Seasonal unemployment appears due to a change in demand based on seasonal variations. Labourers don’t get work round the year. They get employment in the peak season of agricultural activities and become unemployed when these activities are over.

➤ Indian agriculture ensures employment for only 7-8 months and labourers remain unemployed in remaining period this temporary type of employment gives birth to seasonal unemployment.

5. Disguised unemployment: When a person can be removed from the work without affecting the productivity adversely, he will be treated as disguised unemployment.

The marginal productivity of such unemployed person is zero.

➤ Agriculture sector of underdeveloped/developing economic possesses this type of unemployment at a large scale.

6. Educated unemployment: When a educated, trained and skilled person fails to obtain a suitable job suited to his qualification, he is said to be educated unemployment.

➤ At present, thistype of unemployment has became a problem for developing economies, particularly for India.

7. Frictional Unemployment: The unemployment generated due to change in market conditions is called frictional unemployment.

➤ Agriculture is the main occupation in India. The supply conditions still depend on weather’s mood and similarly demand conditions depend on availability of resources. Any change arising either of any or both creates a diversion from the equilibrium which results in frictional unemployment.

DOWNLOAD MOBILE APPLICATION TO LEARN MORE: ECONOMICS QUESTIONS FOR SSC CHSL

Important Fact

➤ In developing countries, which type of unemployment, is found in rural areas—

Underemployment or Disguised unemployment

➤ Who have written the book ‘General Theory of unemployment interest & money’— J.M. Keynes (1936)

➤ In developed countries, which type of unemployment is found—Cyclical and frictional unemployment.

➤ Which sector provided large number of employment after agriculture sector in India—Service sector.

➤ Which unemployment is present in economy in condition of full employment—Frictional unemployment.

➤ According to Lord Keynes, The basic causes of unemployment in developed countries— Aggregate demand or Lack of expenditure.

DOWNLOAD MOBILE APPLICATION TO LEARN MORE: ECONOMICS QUESTIONS FOR SSC CHSL

➤ Which is called standard year and full employment from vision of labour and employment—Those person who get employment opportunities 8 hours per day and 273 day in a year.

➤ Which type of unemployment is found in developing and underdeveloped countries structural unemployment.

➤ Bhagwatti committee is related from-Estimation of unemployment.

➤ In 11th five year plan, which concept has been used for estimation of employment and unemployment-Current daily status (CDS).

➤ At present unemployment is estimated on the basis of-usual status & current daily status (CDS).

➤ Which three concepts has been presented for measurement of unemployment by Bhagwati committee

Usual Status (US), current weekly status and sis current daily status (CDS)

➤ In which five year plan, IRDP, TRYSEM, NREP and RLEGP schemes were implemented-6th five year plan.

DOWNLOAD MOBILE APPLICATION TO LEARN MORE: ECONOMICS QUESTIONS FOR SSC CHSL

Some Poverty Unemployment Alleviation Programme

| Programme/Scheme | Year | Objective |

| Pradhan Mantri Ujjwala Yojana | 1 May, 2016 | Aim to provide free LPG connections to women from below poverty line families |

| Pradhan Mantri Kaushal Vikas Yojana | July 15, 2015 | Skill Development, seeks to provide the institutional capacity to train a minimum 40 crore skilled people by 2011. |

| Pradhan Mantri Awas Yojana (PMAY) | June 25, 2015 | To enable better living and drive economic growth stressing on the need for people centric urban planning and development |

| Atal Mission for Rejuvenation and Urban Transformation (AMRUT) | June 25, 2015 | Urban Development, To enable better living and drive economic growth stressing on the need for people centric urban planning and development |

| Sukanya Samridhi Yojana (Girl-child Prosperity Scheme) | 22 January, 2015 | The scheme primarily ensures equitable share to a girl-child in resources and savings of a family in which generally discriminated as against a male child |

| Heritage city Development and Augmentation Yojana (HRIDAY) | January,2015 | Urban development, the scheme seeks to preserve and rejuvenate the rich cultural heritage of the country |

| Pradhan Mantri Suraksha Bima Yojana | May 9, 2015 | Accidental insurance with a premium of 12 per year |

| Pradhan Mantri Jeevan Jyoti Bima Yojana | May 9, 2015 | Life insurance of 2 lakh with a premium of 330 per day |

| Deen Dayal Upadhyaya Gramin Kaushalya Yojana | 2015 | Rural development, it is a government of India project to engage rural youth especially BPL and SC/ST segment of population, in gainful employment through skill training programmes. |

| Deen Dayal Upadhyaya Gram Jyoti Yojana | 2015 | Rural power supply, aimed at providing 24 × 7 uninterrupted power supply to all homes in Rural India. |

| Atal Pension Yojana | May 9, 2015 | Social sector scheme pertaining. |

DOWNLOAD MOBILE APPLICATION TO LEARN MORE: ECONOMICS QUESTIONS FOR SSC CHSL

AGRICULTURE

Agriculture has been backbone of the Indian Type economy and despite concerted industrialization in the last six decades, agriculture still occupies a place of pride.

➤ Agriculture sector provides employment around 60% of the total work force in the country.

Types of Farming

1. Subsistence Farming: In this farming, the entire production is largely consumed by the farmers and their family and they do not have any surplus to sell in the market. In this type of farming, land holding are small and fragmented. Cultivated crops are cereals along with oil seeds, pulses, vegetables and sugarcane.

DOWNLOAD MOBILE APPLICATION TO LEARN MORE: ECONOMICS QUESTIONS FOR SSC CHSL

2. Commercial Farming: In this type of farming, most of the production is sold in the market for earning money. In this case, farmers use inputs like irrigation, chemical fertilizers, insecticides, pesticides and high yielding varieties of seeds etc. Some of the major commercial crops grown in different parts of India are cotton, Jute, Sugarcane, ground nut etc.

3. Extensive Farming: When we use large patch of land for cultivation then we call it extensive farming. In this farming, total productivity may be high due to larger area but per unit production

is low.

4. Intensive Farming: It records high production per unit of land. Best example of intensive cultivation in Japan where availability of land for cultivation is very limited. Similar kind of situation can be observed in the state of Kerala in India.

5. Plantation Farming: This type of farming involves growing and processing of a single cash crop purely meant for sale. Tea, coffee, rubber, banana and spices are examples of plantation farming.

6. Mixed Farming: It is a situation in which both raising crops and rearing animals are carried on simultaneously. Here farmers engaged in mixed farming are economically better off than others.

DOWNLOAD MOBILE APPLICATION TO LEARN MORE: ECONOMICS QUESTIONS FOR SSC CHSL

➤ All classification are based on nature and purpose of farming.

Major Crops In India

| Types of Crops | Meaning | Major Corps |

| Food Grains | Crops that are used for Human Consumption | Rice, Wheat, Maize, Millets, Pulses and Oil seeds |

| Commercial Crops | Crops which are grown for sale either in raw form or in semi-processed form | Cotton, Jute, Sugarcane, Tobacco and Oil seeds |

| Plantation Crops | Crops which are grown on plantation covering large estates | Tea, Coffee, Coconut and Rubber |

| Horticulture | Section of agriculture in which fruits and vegetables are grown | Fruits and Vegetables |

Crops Season

1. Kharif Crop: This crop is produce in the month of July and harvested in October every year. Kharif crop includes—Rice, Jowar, Bajra, Maize, Cotton, Sugarcane, Seasamum, Soyabean, and Groundnut.

DOWNLOAD MOBILE APPLICATION TO LEARN MORE: ECONOMICS QUESTIONS FOR SSC CHSL

2. Rabi Crop: This crop is produce in October last and harvested in March/April every year. Rabi Crop includes—Wheat, Barley, Gram, Rapeseed, Mustard.

3. Zaid Crop: In some parts of the country a crop known as Zaid crop is grown during March to June every year, Zaid Crop include-Muskmelon, Watermelon, Vegetables, Cucumber, Moong, Urad etc

Major Crops Producing States

| Crops | States |

| Food grains | Uttar Pradesh, Punjab, Madhya Pradesh and West Bengal |

| Wheat | Uttar Pradesh, Punjab, Haryana and Madhya Pradesh |

| Rice | West Bengal, Uttar Pradesh, Punjab and Andhra Pradesh |

| Coarse Cereals | Maharashtra, Karnataka, Rajasthan and Uttar Pradesh |

| Pulses | Madhya Pradesh, Uttar Pradesh, Maharashtra and Rajasthan |

DOWNLOAD MOBILE APPLICATION TO LEARN MORE: ECONOMICS QUESTIONS FOR SSC CHSL

Land Reforms Programmes

➤ Land Reform Programmes in India includes

(a) Tenancy reforms

(b) Consolidation of holdings

(c) Determination of ceiling of holdings per family and to distribute surplus land among landless people.

(d) Elimination of intermediaries

Jai Prakash Mission for Land Development

► Government is planning to establish a separate agency for land reforms and upgradation of wasteland.

► Jai Prakash Mission for land reforms and waste land development will work under ministry of rural development.

► This body will be authorised for making policies and implementing them for land reforms & wasteland upgradation.

DOWNLOAD MOBILE APPLICATION TO LEARN MORE: ECONOMICS QUESTIONS FOR SSC CHSL

New National Agricultural Policy

➤ On July 28, 2000 Union Government has announced new National Agricultural Policy in parliament.

➤ This policy has been planned under the provision of world Trade Organizations so as to face the challenges of agriculture sector.

➤ This policy gives emphasis on promoting agricultural exports after fulfilling domestic demand.

The silent features of this policy are as follows

➤ 4% annual growth rate for next two decades

➤ Greater private sector participation through contract farming

➤ Price protection for farmers

➤ National agricultural insurance scheme to be launched

➤ Rational utilisation of country’s water resources for optimum use of irrigation potential.

➤ High priority to development of animal husbandry, poultry, dairy and aquaculture

➤ Capital inflow and assured markets for crop production.

DOWNLOAD MOBILE APPLICATION TO LEARN MORE: ECONOMICS QUESTIONS FOR SSC CHSL

➤ Exemption from payment of capital gains tax on compulsory acquisition of agriculture land.

➤ Minimum fluctuations in commodity prices.

➤ Continuous monitoring of international prices.

➤ Plant varieties to be protected through a legislation

➤ Adequate and timely supply of quality inputs to farmers

➤ High priority to rural electrification

➤ Setting up of agro-processing units and creation of alf off-farm employment in rural areas.

New Agriculture policy has been described as ‘Rainbow Revolution’. It also includes Food chain Revolution’ to put a check on destroying food grains, vegetables and fruits.

➤ Rainbow Revolution includes the following revolutions—

| Green Revolution | Food grain production |

| White Revolution | Milk production |

| Yellow Revolution | Oil Seeds |

| Blue Revolution | Fisheries |

| Red Revolution | Meat/Tomato Production |

| Golden Revolution | Fruits/Apple production |

| Grey Revolution | Fertilizer production |

| Black/Brown Revolution | Non conventional energy sources |

| Silver Revolution | Egg production |

| Round Revolution | Potato Production |

DOWNLOAD MOBILE APPLICATION TO LEARN MORE: ECONOMICS QUESTIONS FOR SSC CHSL

Green Revolution in India

➤ The first agriculture research centre was established by agriculture scientists J.V Bosingault at Ellses in 1834. It was a centre which initiated agricultural research

➤ American society of Agronomy was established in 1908 which accelerated agricultural development in America.

➤ Indian society of Agronomy was established in fifties of 20th century.

➤ During 1958, *for the first time in India wheat production increased from 120 lakh tonnes to 170 lakh tonnes. American Scientist Dr. William Gande termed it as green revolution.

DOWNLOAD MOBILE APPLICATION TO LEARN MORE: ECONOMICS QUESTIONS FOR SSC CHSL

➤ During the middle of sixties, Indian Agricultural scientists developed a number of new high yielding varieties of wheat by processing wheat seeds imported from Maxico.

➤ Introduction of high yielding varieties, a true; green revolution was observed in middle of sixties which ensured India’s self dependence in food grains. The credit for it goes not only to Nobel laureate Dr. Norman Borlaug but also to Dr. M.S.Swaminathan.

➤ Green Revolution still possess potentialities of increasing production of wheat 2.5 times, rice 3 times, maize 3.5 times, jowar 5 times and bajra 5.5 times.

➤ During 1960-61 a programme named ‘Intensive Agriculture District Programme (IADP) was introduced in 7 districts of the country. This programme was aimed to provide credit loans, fertilizers, equipments, seeds etc to the farmer’s band to prepare an infrastructure for intensive farming in other areas of the country.

➤ During 1964-65, second similar programme named Intensive Agriculture Area Programme (IAAP) was introduced in other parts of the country.

DOWNLOAD MOBILE APPLICATION TO LEARN MORE: ECONOMICS QUESTIONS FOR SSC CHSL

➤ Both programmes (IADP and IAAP) were related to intensive farming but their operation was limited to traditional varieties of Crops.

➤ Due to severe drought in 1965-66 and in 1966-67, government adopted the new agriculture policy using HYVS (High Yielding Variety Seeds) for accelerating agricultural production.

Evergreen Revolution

➤ The pioneer of Indian Green Revolution Mr. M.S. Swaminathan presently chairman of National Commission on farmers gave a new call for Evergreen Revolution’ for doubling the present production level of food grains from 210 million tonnes to 420 million tonnes.

➤ For making Evergreen Revolution’ a success he stressed on adopting best scientific techniques and promoting organic farming. He also mentioned four prerequisites for getting the success.

DOWNLOAD MOBILE APPLICATION TO LEARN MORE: ECONOMICS QUESTIONS FOR SSC CHSL

(a) Promoting soil health

(b) Promoting ‘Lab-to-land exhibition’

(c) Making rainwater harvesting compulsory

(d) Providing credit to farmers on suitable conditions

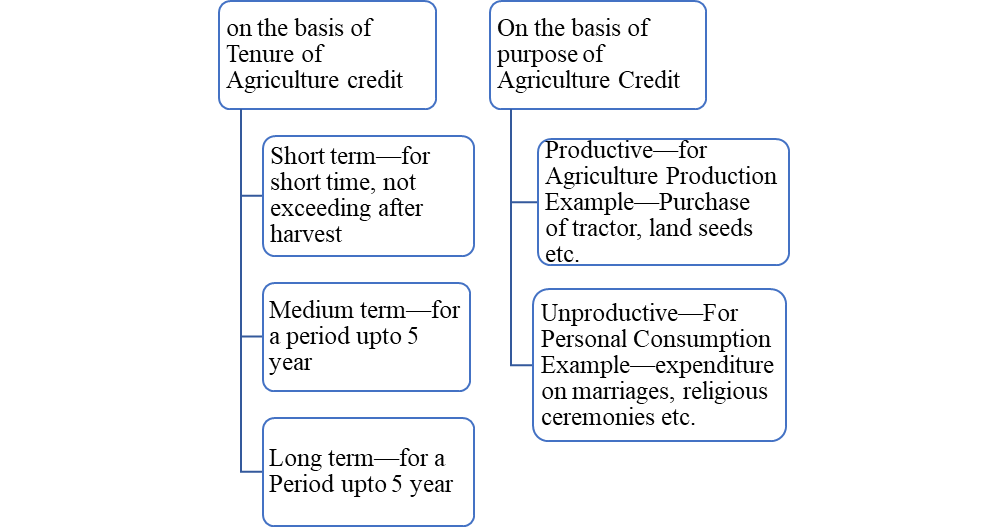

Agriculture Credit

Agriculture Credit is an important per requisite for agricultural growth. Agricultural policies have been reviewed from time to time to provide adequate and timely availability of finance to this sector.

DOWNLOAD MOBILE APPLICATION TO LEARN MORE: ECONOMICS QUESTIONS FOR SSC CHSL

Types of Agriculture Credit

DOWNLOAD MOBILE APPLICATION TO LEARN MORE: ECONOMICS QUESTIONS FOR SSC CHSL

Source of Agriculture Credit in India

There are two broad sources of agriculture credit in India

1. Non Institutional Sources: The non-institutional finance forms an important source of rural credit in India, constituting around 40% of total credit in India. The important sources of Non-institutional credits are Money lenders, Traders, landlords and commission agents.

2. Institutional Sources: NABARD (National Bank for Agriculture and Rural Development) is an apex institution established in 1982 for rural credit in India. Some institutions are

(a) Rural Co-operative Credit Institutions: The rural credit Co-operatives divided into short-term credit cooperatives and long term credit cooperatives.

➤ The short term credit cooperatives provide short term rural credit and are based on three-tier structure i.e. Primary Agriculture Credit Societies (PACS), District Central Cooperative Banks and State Co-operative Banks (SCBS)

➤ Long term credit provides long term credit to the farmers and are organized at two levels. i.e. primary Co-operative Agriculture and Rural Development Banks and State co-operatives Agriculture and Rural Development Banks.

(b) Commercial Banks

(c) Regional Rural Banks

(d) Micro Finance institutions (MFIs)

DOWNLOAD MOBILE APPLICATION TO LEARN MORE: ECONOMICS QUESTIONS FOR SSC CHSL

Micro Irrigation

The centrally sponsored National Mission on Micro Irrigation (NMMI) was launched in June 2010 in addition to the earlier micro irrigation scheme launched in January 2006.

➤ The mission was implemented during the 11th plan period for enhancing water-use efficiency by adopting drip and sprinkler irrigation systems in all states and Union Territories for both horticulture and agricultural crops.

➤ The scheme provide assistance at 60% of the system cost for small and marginal farmers and at 50% for general farmers.

➤ Micro irrigation scheme is beneficial for farmers in increasing crop productivity and water use Is efficiency, reducing fertilizer consumption and electricity and labour consumption, enhancing income.

➤ The main objective of this scheme is to increase the coverage area under improved methods of irrigation in the country for better water use efficiency along with other benefits like fertilization, quality production etc to provide stimulus to growth in agriculture sector.

DOWNLOAD MOBILE APPLICATION TO LEARN MORE: ECONOMICS QUESTIONS FOR SSC CHSL

National Rainfed Area Authority (NRAA)

➤ The government of India has also constituted the NRAA to give focused attention to the problem of rainfed areas of the country.

➤ The authority is an advisory policy making and monitoring body charged with examining guidelines in various existing schemes and in the formulation of new schemes including externally aided projects in this area.

➤ It would also focus on issues pertaining to landless and marginal farmers, since they constitute the large majority of inhabitants of rainfed areas.

➤ The NRAA has formulated common guidelines for the watershed Development project and is in consultation with all states for its implementation as per instructions contained in the guidelines.

DOWNLOAD MOBILE APPLICATION TO LEARN MORE: ECONOMICS QUESTIONS FOR SSC CHSL

Command Area Development & Water Management Programme

➤ Central government sponsored Command Area Development (CAD) programme was launched in 1974-75.

➤ The main objective of CAD is improving the utilisation of created irrigation potential and optimizing agriculture production and productivity from irrigated lands on a sustainable basis, by integrating all functions related with irrigated agriculture through a multi-disciplinary team under an Area Development Authority.

➤ The CAD Programme has been restructured and renamed as ‘Command Area Development and Water Management Programme (CADWMP) w.e.f April 1, 2004.

DOWNLOAD MOBILE APPLICATION TO LEARN MORE: ECONOMICS QUESTIONS FOR SSC CHSL

➤ The CAD programme was initiated with 60 major and medium irrigation projects. So far 314 irrigation projects with a Culturable Command Area (CCA) of about 28.68 mha have been included under the programme, out of which 136 projects are ongoing.

Pradhan Mantri Krishi Sinchayee Yojana (PMKSY)

➤ Pradhan Mantri Krishi Sinchayee Yojana has been formulated with the vision of extending the coverage of irrigation Her Khet Ko Pani’ and improving water use efficiency More Crop Per Drop’.

➤ The Cabinet Committee on Economic Affairs chaired by Hon’ble Prime Minister has accorded approval of Pradhan Mantri Krishi Sinchayee Yojana (PMKSY) in its meeting held on 1st July, 2015.

➤ PMKSY has been formulated amalgamating ongoing schemes i.e. Accelerated Irrigation Benefit Programme (AIBP) of the Ministry of Water Resources, River Development and Ganga Rejuvenation (MoWR, RD & GR), Integrated watershed Management Programme (IWMP) of Department of Land Resources (DoLR) and the On Farm Water Management (OFWM) of Department of Agriculture and Cooperation (DAC).

Pradhan Mantri Fasal Bima Yojana (PMFBY)

On 13 January 2016, Hon’ble prime minister Narendra Modi unveiled the new scheme Pradhan Mantri Fasal Bima Yojana (PMFBY), administered under the Ministry of Agriculture and farmer’s welfare, Government of India. This scheme will be implemented on ‘Area Approach Basis’.

DOWNLOAD MOBILE APPLICATION TO LEARN MORE: ECONOMICS QUESTIONS FOR SSC CHSL

Provision Under This Scheme

➤ There will be a uniform premium of only 2% to be paid by farmers for all kharif crops and 1.5% for all Rabi crops. In case of annual commercial and horticultural crops, the premium will be paid 5%.

➤ The Premium rates to be paid by farmers are very low and balance premium will be paid by the government to provide full insured amount to the farmers against crop loss in any natural calamites.

➤ There is no upper limit on government subsidy. Even if balance premium is 90%, it will be borne by the government.

DOWNLOAD MOBILE APPLICATION TO LEARN MORE: ECONOMICS QUESTIONS FOR SSC CHSL

➤ Earlier, there was a provision of capping the premium rate which is low claims being paid to farmers. Now this is removed and farmers will get claim against full sum insured without any reduction.

Objectives of PMFBY

➤ To provide insurance coverage and financial support to the farmers in the event of failure of any of the notified crop as a result of natural calamities, pests and diseases.

➤ To stabilize the income of farmers to ensure their continuous process in farming.

➤ To encourage farmers to adopt innovative and modern agricultural practices.

➤ To ensure flow of credit to the agriculture sector.

Seed Bank

➤ A scheme for the establishment and maintenance of a seed bank has been in operation since 1999- 2000.

➤ The basic objective of the scheme is to make available seeds for meeting any contingent requirement and also develop infrastructure for production and distribution of seeds.

➤ The scheme is being implemented through National Seeds corporations, state farms corporation of India and 12 state seeds corporations of various states.

DOWNLOAD MOBILE APPLICATION TO LEARN MORE: ECONOMICS QUESTIONS FOR SSC CHSL

White Revolution and Operation Flood in India

➤ During 1964-65, Intensive Cattle Development Programme (ICDP) was introduced in the country in which a package of improved animal husbandry It was given to cattle owners for promoting white revolution in the country.

➤ White revolution is associated with a sharp increase in milk production. Later on, to accelerate the pace of white revolution, a new programme named ‘Operation Flood’ was introduced in the country.

➤ Dr. Varghese Kurein is the pioneer of operation flood in India.

➤ Operation flood programme was started in 1970 by National Dairy Development Board (NDDB). The programme has completed its III phase in April 1996.

➤ India ranks 1st in milk production, accounting for 18.5% of world production. USA stands 2nd in the world.

DOWNLOAD MOBILE APPLICATION TO LEARN MORE: ECONOMICS QUESTIONS FOR SSC CHSL

INFRASTRUCTURE

Infrastructure

Infrastructure provides supporting services in the main area of industrial and agricultural production, domestic foreign trade and commerce. These services include roads, railways, ports, airports, dams, power stations, oil and gas pipelines, telecommunication facilities, the educational system including schools and colleges, country’s health system including hospitals, sanitary system including clean drinking water facilities and the monetary system including banks, insurance another financial institutions.

➤ Infrastructure divided into two categories economic and social.

(a) Transport-Railway, Road, Shipping and civil aviation

(b) Energy Coal, Electricity, oil and gas

(c) Communication-Telecommunication and post office.

Energy

The most important single factor which can act as a constraint on economic growth of a country is the availability of energy.

➤ India is both a major energy producer and consumer.

➤ Currently, India ranks as the world’s 7th largest energy producer and 5th largest energy consumer.

DOWNLOAD MOBILE APPLICATION TO LEARN MORE: ECONOMICS QUESTIONS FOR SSC CHSL

Sources of Energy

There are two sources of energy-commercial energy and non commercial energy.

➤ Commercial energy consist of coal, petroleum and Commercial energy accounts for over In 50% of all energy consumption in India.

➤ Non-commercial sources of energy also known as traditional sources of energy that consist firewood, vegetable wastes and dried dung. These are called non-commercial sources, as they are supposed to be free and command no-price.

➤ More than 60% of Indian households depend on traditional sources of energy for meeting their cooking and heating needs.

DOWNLOAD MOBILE APPLICATION TO LEARN MORE: ECONOMICS QUESTIONS FOR SSC CHSL

National Mineral Policy 2008

Due to recommendation of Hoda Committee (which was constituted by planning commission) to review the National Mineral policy 2008, was approved by the government. The policy advocates the following:

➤ Development of Capital market structures to attract risk investment into survey and prospecting.

➤ Framework for sustainable development to take care of biodiversity issues.

➤ Auction of ore bodies prospected at public expenses.

➤ Independent Mining Administrative Tribunal.

➤ Use of state of the art technology for exploration.

➤ Zero waste mining and transparency in allocation of concessions.

DOWNLOAD MOBILE APPLICATION TO LEARN MORE: ECONOMICS QUESTIONS FOR SSC CHSL

Coal Mines Bill, 2015

Mr. Piyush Goyal, Minister of coal has been introduced Coal Mines Bill, 2014 in Lok Sabha on December 10, 2014. It was first passed in Lok Sabha on March 4, 2015 and later in Rajya Sabha on March 20, 2015. This bill will replace the coal mines (special provisions) second ordinance, 2014.

➤ It seeks to amend the Coal Mines Act, 1973 and the Mines and Minerals, 1957.

➤ The coal bill loosen the mining monopoly of state owned coal India Ltd, while the mines bill imparts greater transparency to the sector and bestows greater financial autonomy to states with minerals bearing mines.

Non conventional sources of energy

The important non conventional sources of energy are solar energy, wind energy, Bio-gas, Geo-thermal energy, Small Hydro Power (SHP) and woody biomass power.

Jawahar Lal Nehru National Solar Mission (JNNSM)

➤ JNNSM was started by the Prime Minister Dr. Manmohan Singh on January 11, 2010. It was estimated to increase the number of photovoltaic cells capacity 1040.67 by the end of July 2012.

➤ Generation of 20,000 MW Solar energy is the target of this mission.

➤ In an another efforts for the popularization and developing the solar energy the ministry of renewable energy has planned to 60 cities as the ‘solar city’.

➤ In theoretical approach, the plan has been sanctioned for 48 such cities. These cities are-Bilaspur and Raipur (Chhattisgarh), Indore, Gwalior, Rewa and Bhopal (M.P), Agra and Moradabad (U.P), Dehradun, Haridwar Rishikesh, Chamoli, Gopeshwar (Uttarakhand), Shimla and Hamirpur (H.P), Gurgaon and Faridabad (Haryana).

DOWNLOAD MOBILE APPLICATION TO LEARN MORE: ECONOMICS QUESTIONS FOR SSC CHSL

UDAY Scheme

➤ Union Cabinet has given its approval to a new scheme moved by the ministry of power i.e., Ujwal, Discom Assurance Yojana or UDAY.

➤ UDAY provides for the financial turn around and revival of power distribution companies (DISCOMs) and also ensures a sustainable permanent solution to the problem.

➤ UDAY assures the rise of efficient and vibrant DISCOMs through a permanent resolution of past as well as potential future issues of the sector. It empowers DISCOMs with the opportunity to break even in the next 2-3 years. This is through four initiatives —

(a) Reduction of cost of power.

(b) Reduction in interest cost of DISCOMS.

(c) Enforcing financial discipline on through alignment with state finances. DISCOMS

(d) Improving operational efficiencies of DISCOMs.

DOWNLOAD MOBILE APPLICATION TO LEARN MORE: ECONOMICS QUESTIONS FOR SSC CHSL

Features of UDAY

➤ Government of India will not include the debt taken over by the states as per the above scheme in the calculation of fiscal deficit of respective states in the financial years 2015-16 and 2016-17.

➤ State DISCOMs will comply with the Renewable Purchase Obligation (RPO) outstanding since

1st April 2012, Within a period to be decided in consultation with ministry of power.

➤ States shall take over 75% of DISCOM debt as on September 30, 2015 over two years 50% of DISCOM debt shall be taken over in 2015-16 and 25% in 2016-17.

Transport in India

The present transport system of the country comprises several modes of transport including Rail, Road, Coastal Shipping

Road Transport

The total road length of the country increased from 3.99 lakh kms on 31st March, 1951 to 46.99 lakh kms as on 31st March, 2014, growing at a Compound Annual Growth Rate (CAGR) of 4.2%. About 60% freight traffic and 87.4% passenger traffic is carried by the roads.

➤ At present Indian Road network of 46.99 lakh km is the one of the largest in the world

➤ They are constructed and maintained by the central government.

DOWNLOAD MOBILE APPLICATION TO LEARN MORE: ECONOMICS QUESTIONS FOR SSC CHSL

➤ According to NHAI the National Highways Constitute only 1.7% of the road network, but carry about 40% of the total road traffic of India.

➤ The development and maintenance of the National Highway System is carried out through three agencies

(a) National Highways Authority of India (NHAI)

(b) State Public Work Departments (PWDs)

(c) Border Roads Organization (BRO)

➤ In order to give boost to the economic development of the country, the government has embarked upon a massive National Highways Development Project (NHDP) in the country.

➤ The NHDP is the largest highway project even undertaken in the country.

➤ The NHDP is being implemented mainly by National Highway Authority of India (NHAI)

GAGAN

GPS Aided GEO Augmented Navigation (GAGAN) System is a prestigious satellite based augmentation system of India, jointly developed by Airport Authority of India (AAI) and Indian Space Research Organization (ISRO) for enhanced Air Navigation Service across the country.

DOWNLOAD MOBILE APPLICATION TO LEARN MORE: ECONOMICS QUESTIONS FOR SSC CHSL

Inland Waterways Authority of India (IWAI)

➤ The IWAI came into existence on 27th October, 1986 for development and regulation of inland waterways for shipping and navigation. The Authority primarily undertakes projects for development and maintenance of IWT infrastructure on national water ways through grant received from Ministry of Shipping.

➤ The Head Office of the IWAI is at NOIDA (UP).

➤ The authority has its regional office at Patna, Kolkata, Guwahati and Kochi and sub offices at Allahabad, Varanasi, Bhagalpur, Farakka, Hemnagar, Dibrugarh, Kollam, Chennai and Vijaywada.

BANKING

Bank

The word ‘Bank’ is derived from the Greek word banque or the Halian word banco both meaning is bench. It refers which money lenders and money changers used to display their coins and transact business in the market place.

There are other financial institutions like the unit Trust of India (UTI), the life insurance corporation (LIC), the industrial finance corporation of India (IFCI), the industrial development bank of India (IDBI) etc which lend money to others but do not accept chequable demand deposits. Therefore they are not regarded as banks. They are called Non Banking Financial Institutions.

DOWNLOAD MOBILE APPLICATION TO LEARN MORE: ECONOMICS QUESTIONS FOR SSC CHSL

Types of Bank

Banks in the organised sector may be classified into the following major forms

1. Commercial Banks

2. Co-operative Banks

3. Specialised Bank

4. Central Banks

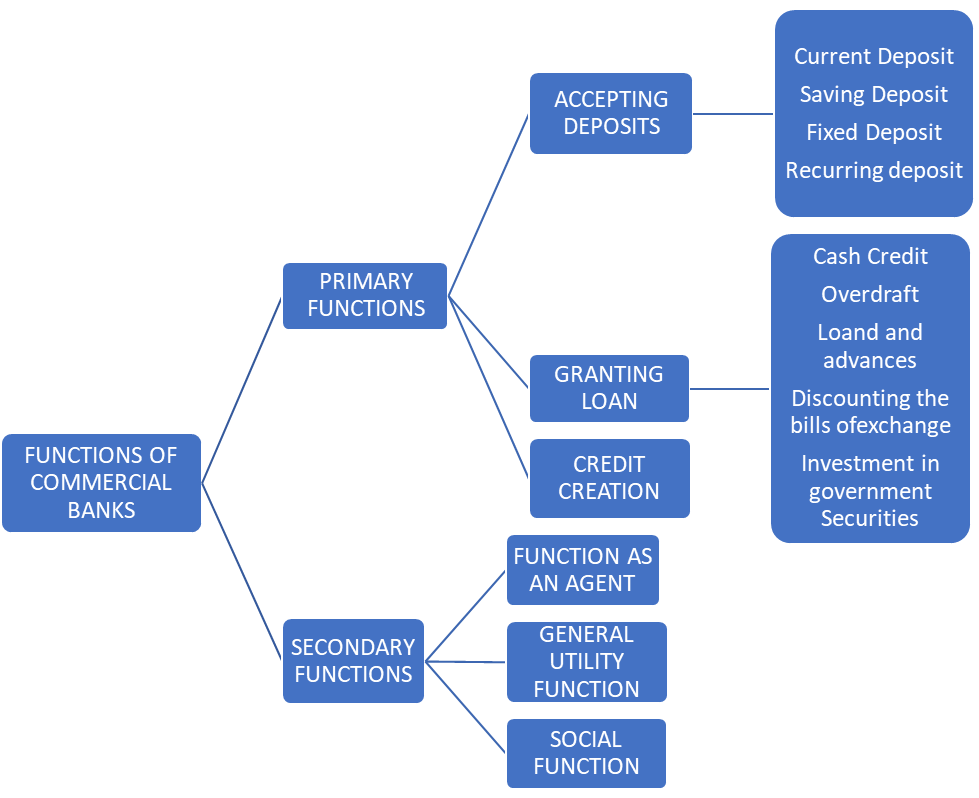

1. Commercial banks: Commercial banks are joint stock companies deal money and credit. A commercial bank is as a financial institution that accepts chequable deposits of money from the public and also uses the money with it for lending.

DOWNLOAD MOBILE APPLICATION TO LEARN MORE: ECONOMICS QUESTIONS FOR SSC CHSL