DOWNLOAD MOBILE APPLICATION TO LEARN MORE: NATIONAL INCOME AND RELATED AGGREGATES FOR CLASS 12

DOWNLOAD MOBILE APPLICATION TO LEARN MORE: NATIONAL INCOME AND RELATED AGGREGATES FOR CLASS 12

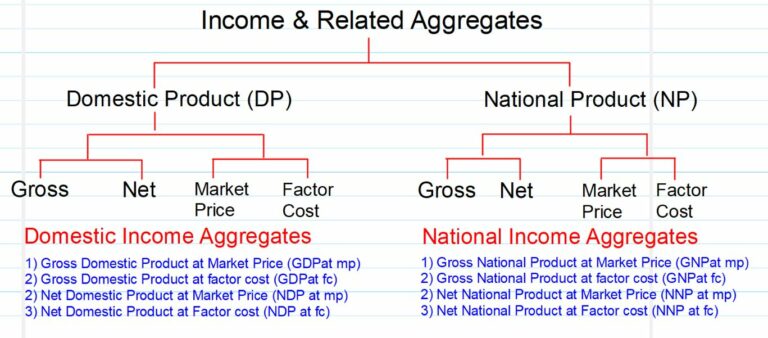

National Income is the sum total of factor incomes accruing to normal residents of a country. It does not account for transfer incomes

Factor Incomes are the rewards of the factor of production, viz. compensation of employees, rent, interest and profit.

Transfer Incomes are unearned incomes. These include gifts in cash, scholarships to the students, old-age pensions to the senior, etc. These are not included in the estimation of the national income.

Normal Residents of a Country are the people who (i) normally reside in the country concerned, and (ii) whose centre of economic interest lies in the country concerned.

DOWNLOAD MOBILE APPLICATION TO LEARN MORE: NATIONAL INCOME AND RELATED AGGREGATES FOR CLASS 12

Domestic Income is the sum total of factor incomes generated within the domestic territory of the country (no matter it is the income accruing to residents or non-residents of the country).

Conversion of Domestic Income into National Income:

Domestic income + Net factor income from abroad = National Income

Domestic Territory of a Country is the economic territory of the country in which economic activities of the country generate its domestic income.

DOWNLOAD MOBILE APPLICATION TO LEARN MORE: NATIONAL INCOME AND RELATED AGGREGATES FOR CLASS 12

Net Factor Income from Abroad (NFA) is the difference between the factor income earned by our residents from abroad and factor income earned by non-residents in our country.

Domestic Income does not include net factor income from abroad.

National Income includes net factor income from abroad.

Gross and Net Concepts

Gross Domestic Product is the market value of final goods and services produced within the domestic territory of the country during an accounting year, inclusive of depreciation.

Net Domestic Product is the market value of final goods and services produced within the domestic territory of the country during an accounting year, exclusive of depreciation.

Conversion of GDP into NDP:

GDP – Depreciation = NDP

Market Price and Factor Cost

Market Price includes the impact of indirect taxes (taxes on goods and services) and subsidies.

Indirect Tax raises the market price, subsidies tend to lower it.

Factor Cost is the cost of factors of production. It is equal to factor patients.

DOWNLOAD MOBILE APPLICATION TO LEARN MORE: NATIONAL INCOME AND RELATED AGGREGATES FOR CLASS 12

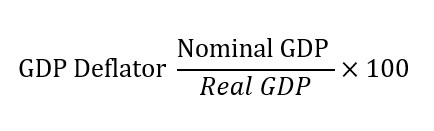

Nominal GDP is the market value of goods and services produced within the domestic territory of a country during an accounting year as estimated using the current year prices.

Real GDP is the market value of goods and services produced within the domestic territory of a country during an accounting year, as estimated using the base year prices.

Conversion of Nominal GDP into Real GDP:

GDP Deflator is the ratio between nominal GDP and real GDP. It shows change in GDP owing to the change in the price level. It is also called price index.

GDP and Welfare

Real GDP is a widely used index of welfare. But it suffers from certain limitations as it ignores:

(I) distribution of income, (ii) composition of GDP (iii) non monetary transactions, (iv) externalities.

DOWNLOAD MOBILE APPLICATION TO LEARN MORE: NATIONAL INCOME AND RELATED AGGREGATES FOR CLASS 12

Table of Contents

NATIONAL INCOME AND RELATED AGGREGATES FOR CLASS 12

1. Market price of the final goods and services (including depreciation) produced within the domestic territory of a country during an accounting year, is called:

(a) GDP at market price

(b) GNP at market price

(c) GDP at factor cost

(d) GNP at factor cost

2. National income is often estimated as:

(d) NNP

3. Domestic product is equal to:

(a) National product + Net factor income from abroad

(b) National product – Net factor income from abroad

(c) National product ÷ Net factor income from abroad

(d) National product × Net factor income from abroad

4. Net indirect taxes are estimated as:

(a) Indirect taxes + 5ubsidies

(b) Subsidies-Indirect taxes

(c) Indirect taxes – Subsidies

(d) both (b) and (c)

5. Which of the following is not correct?

(a) NNP at 4etPrice = GNP at market price + Depreciation

(b) NDP at Market Price = NNP at market price-Net factor income from abroad

(c) NDP at Factor Cost = NDP at market price-Indirect taxes + Subsidies

(d) GDP at Factor Cost = NDP at factor cost + Depreciation

DOWNLOAD MOBILE APPLICATION TO LEARN MORE: NATIONAL INCOME AND RELATED AGGREGATES FOR CLASS 12

6. Which one is correct?

(a) National Income = NDP at factor cost-Net factor income from abroad

(b) GNP at Factor Cost = GNP at market price Net indirect tax

(c) National Income = Domestic income + Net factor income from abroad

(d) GDP at Factor Cost = NDP at factor cost-Depreciation

7. Basis of the difference between the concepts of market price and factor cost is:

(a) direct taxes

(b) indirect taxes

(c) subsidies

(d) net indirect taxes

8. Which one leads to factor cost?

(a) Market Price-Indirect taxes

(b) Market Price-Net indirect taxes

(c) Market price + Indirect taxes

(d) Market price + Net indirect taxes

9. Which one includes depreciation?

(a) GNP at market price

(b) NNP at market price

(c) NNP at factor cost

(d) None of these

10. Which of the following is an example of normal residents of India?

(a) Foreign worker working in WHO located in India

(b) The German working as Director in IMF office located in India

(c) Ambassador in India from rest of the world

(d) Ambassador of India in rest of the world

DOWNLOAD MOBILE APPLICATION TO LEARN MORE: NATIONAL INCOME AND RELATED AGGREGATES FOR CLASS 12

11. National income includes

(a) old-age pensions

(b) money sent by an hill to his family in India

(c) transfer payments from rest of the world

(d) none of these

12. Financial help to a victim is

(a) transfer payment

(b) factor income

(c) net factor income from abroad

(d) none of these

13. The difference between national income and domestic income is that of

(a) net indirect taxes

(b) net factor income from abroad

(c) consumption of fixed capital

(d) both (a) and (c)

14. GNP at market price is measured as:

(a) GDP at market price-Depreciation

(b) GDP at market price-Net factor income from abroad

(c) GNP at market price. Subsidies

(d) NDP at factor cost + Net factor income from abroad

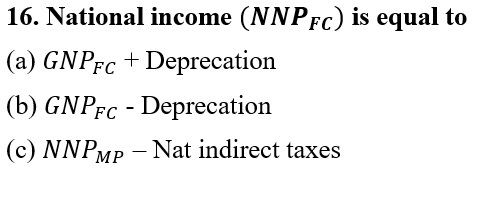

15. National income refers to:

(a) factor incomes only

(b) income of only normal residents of the country

(c) the sum total of domestic income and net factor income from abroad

(d) all of these

DOWNLOAD MOBILE APPLICATION TO LEARN MORE: NATIONAL INCOME AND RELATED AGGREGATES FOR CLASS 12

17. Which of the following makes GDP an inappropriate index of welfare?

(a) Non-monetary transactions

(b) Externalities

(c) Composition and distribution of GDP

(d) All of these

18. The impact of an externality is

(a) positive

(b) negative

(c) either positive or negative

(d) neither positive or negative

19. Real national income means:

(a) national income at current prices

(b) national income at factor prices

(c) national income at constant prices

(d) national income at average prices of the past 10 year

DOWNLOAD MOBILE APPLICATION TO LEARN MORE: NATIONAL INCOME AND RELATED AGGREGATES FOR CLASS 12

20. GDP Deflator =

DOWNLOAD MOBILE APPLICATION TO LEARN MORE: NATIONAL INCOME AND RELATED AGGREGATES FOR CLASS 12

21. Increase in price of commodities due to increase in taxes assumes relevance in the estimation of

(a) taxes are compulsory payments

(b) taxes are transfer payments

(c) taxes are paid out of income of the households

(d) takes cause a rise in market price of the commodities which otherwise would have been sold at a lower price

Answers

| 1. (a) | 9. (a) | 17. (d) |

| 2. (d) | 10. (d) | 18. (c) |

| 3.(b) | 11. (d) | 19. (c) |

| 4. (c) | 12. (a) | 20. (b) |

| 5. (a) | 13. (b) | 21. (d) |

| 6. (c) | 14. (b) | |

| 7. (d) | 15. (d) | |

| 8. (b) | 16. (d) |

DOWNLOAD MOBILE APPLICATION TO LEARN MORE: NATIONAL INCOME AND RELATED AGGREGATES FOR CLASS 12

Matching the Correct Statements

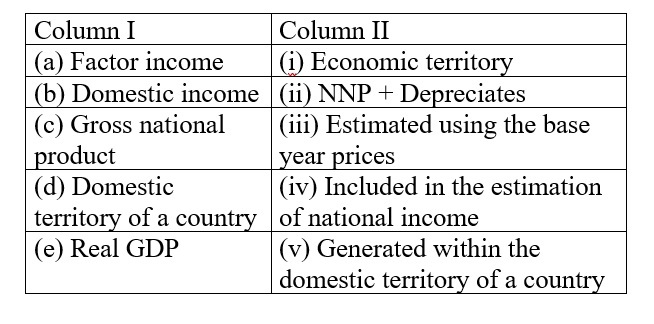

I. From the set of statements given in Column I and Column Ii, choose the correct pair of statements:

Answer

(b) GDP at constant prices – (ii) A good measure of welfare of people

II. Identify the correct sequence of alternatives given in Column II by matching them with respective items in Column I:

DOWNLOAD MOBILE APPLICATION TO LEARN MORE: NATIONAL INCOME AND RELATED AGGREGATES FOR CLASS 12

Answers

(a) – (iv)

(b) – (v)

(c) – (ii),

(d) – (i)

(e) – (iii)

DOWNLOAD MOBILE APPLICATION TO LEARN MORE: NATIONAL INCOME AND RELATED AGGREGATES FOR CLASS 12

Very Short Answer’ Objective Type Questions

1. Define gross domestic product at market price.

Ans. Gross domestic product at market price refers to market value of final goods and services produced within the domestic territory of the country within one year, inclusive of depreciation.

2. Define net domestic product at market price.

Ans. Net domestic product at market price refers to market value of final goods and services produces within the domestic territory of the country within one year, exclusive of depreciation.

3. Define domestic product at factor cost or domestic income.

Ans. Domestic product at factor cost or domestic income is the sum total of factor incomes generated within the domestic territory of the country during the period of one year along with the depreciation or consumption of fed capital.

4. When is gross domestic product of an economy equal to its gross national product?

Ans. Gross domestic product of an economy equal to its gross national product when net factor income from abroad is zero.

DOWNLOAD MOBILE APPLICATION TO LEARN MORE: NATIONAL INCOME AND RELATED AGGREGATES FOR CLASS 12

5. Define factor income.

Ans. Factor income is the income received by owners of the factors of production in the form of rent, wages interest and profit for the services rendered in the production process.

6. What a meant by transfer incomes?

Ans. Transfer incomes are those incomes corresponding to which there is no value addition in the economy. Example: Gifts and donations.

7. What is meant by nominal GDP?

Ans. Nominal GDP refers to market value of the final goods and services produced within the domestic territory of a country during an accounting year, as estimated using the current year prices. It may increase without any increase in the quantum of output in the economy.

8. What is meant by real GDP?

Ans. Real GDP refers to market value of the final goods and services produced within the domestic territory of a country during an accounting year, as estimated using the base year prices. It increases only when there increase in the quantum of output in the economy.

DOWNLOAD MOBILE APPLICATION TO LEARN MORE: NATIONAL INCOME AND RELATED AGGREGATES FOR CLASS 12

Reason-based Questions

Read the following statements carefully. Write True or False with a reason.

1. Domestic product refers to value addition only by the resident producers.

Ans. False Domestic product/income to by to come generated in the domestic territory of a country by all producers (resident and non re dent) during one year.

2. Net factor income from abroad is treated as a component of income from domestic product accruing to the government sector.

Ans. False. Net factor income from abroad is a component of national income. It is added to domestic income to get national income.

3. There is no difference between GDP at market price and GDP at factor cost in a two-sector economy including household sector and producer sector.

Ans. True Difference between GDP at market price and GDP at factor cost is the net indirect taxes.

Net indirect taxes = Indirect taxes – Subsidies

The parameters of tax and subsidies emerge only when we are considering a three-sector economy including households, producers and the government.

DOWNLOAD MOBILE APPLICATION TO LEARN MORE: NATIONAL INCOME AND RELATED AGGREGATES FOR CLASS 12

4. GDP growth as an index of welfare loses its significance if there is a deep economic divide in the economy.

Ans. True Economic divide indicates the increasing gulf between the rich and poor people. If the gulf increases, GDP growth loses its significance.

5. National income at current prices can increase even when the quantum of goods and services produced during the year remains constant.

Ans. True Increase in the price level can cause an increase in national income at current prices without increase in the quantum of goods and services.

6. National income is always greater than domestic income.

Ans. False National income can be less than domestic income National income is greater than e income only when net factor income from abroad is some positive, number.

7. increase in national income always implies increase in domestic income.

Ans. False National income = Domestic income + Net factor income from abroad.

This equation shows that national income can increase when net factor come from abroad increases even when domestic income is constant.

8. National income at market price is always greater than national income at factor cost.

Ans. False. National income at market price = National income at factor cost + Net indirect taxes.

National income at market price can be less than national income at factor cost in case net indirect taxes is a negative number.

DOWNLOAD MOBILE APPLICATION TO LEARN MORE: NATIONAL INCOME AND RELATED AGGREGATES FOR CLASS 12

9. Domestic income as well as national income include only factor incomes.

Ans. True. National income is the sum total of factor incomes earned by normal residents of a country during a given year. Domestic income in the sum total of factor incomes generated within the domestic territory of a country.

10. Market price includes the impact of indirect taxes, but not of subsidies.

Ans. False. Market price includes the impact of both indirect taxes and subsidies. Indirect taxes raise the market price while subsidies lower it.

11. Net indirect taxes are never equal to zero.

Ans. False. Net indirect taxes are equal to zero in case indirect taxes are equal to subsidies.

12. Increase in national income implies increase in the flow of goods and services in the economy.

Ans. True. Provided that, national income (as the market value of final goods and services produced during the year) is estimated at constant prices, NOT at current prices.

DOWNLOAD MOBILE APPLICATION TO LEARN MORE: NATIONAL INCOME AND RELATED AGGREGATES FOR CLASS 12

Q. Write two observations indicating the difference between domestic income and national income.

Ans. Following observations indicate the difference between domestic income and national income:

DOWNLOAD MOBILE APPLICATION TO LEARN MORE: NATIONAL INCOME AND RELATED AGGREGATES FOR CLASS 12

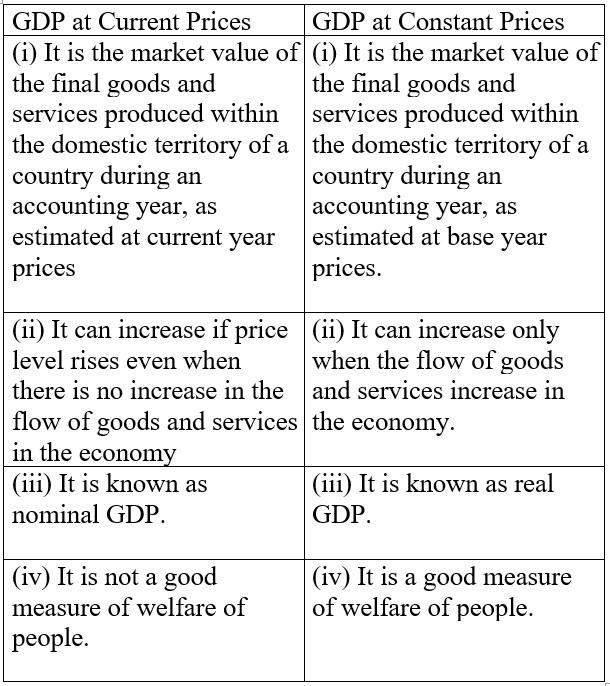

Following observations indicate the difference between GDP at current prices and GDP at constant prices:

DOWNLOAD MOBILE APPLICATION TO LEARN MORE: NATIONAL INCOME AND RELATED AGGREGATES FOR CLASS 12

Q. What lowers the significance of GDP as an index of welfare?

Ans. The following observations explain how the significance of GDP as an index of welfare is lowered:

(i) Distribution of Income: GDP as an index of welfare loses significance if the distribution of income turns unequal.

(ii) Composition of GDP: If luxuries are produced for richer sections of the society and the poor suffer deprivation, GDP growth becomes meaningless.

(iii) Non-monetary Exchanges/Transactions: Larger the non-monetary transactions, greater the underestimation of GDP as an index of welfare.

(iv) Externalities: GDP index does not account for externalities: the good and bad impact of economic activities without the price or penalty. Environmental pollution related to production activity is an important example. This also lowers the significance of GDP as an index of welfare.

DOWNLOAD MOBILE APPLICATION TO LEARN MORE: NATIONAL INCOME AND RELATED AGGREGATES FOR CLASS 12

HOTS & Application based Questions

1. When will domestic factor income be greater than national income?

Ans. Domestic factor income is greater than national income when net factor income from abroad is negative.

2. In the determination of social welfare, what matters is the quantum of output rather than the composition of output Defend or refute?

Ans. The above statement is incorrect social welfare depends both on the quantum of output as well as the composition of output. If goods are produced primarily t richer sections of the society (ignoring the interest of poorer sections of the society), social welfare bound to remain low even when the quantum of output is rising.

DOWNLOAD MOBILE APPLICATION TO LEARN MORE: NATIONAL INCOME AND RELATED AGGREGATES FOR CLASS 12

3. Profits earned by a company in India, which is owned by a non-resident is included in national income of India? Is it true?

Ans. No. Because this is the income which does not belong to the normal residents of India.

Note: Profits earned by a company in India, which is owned by a non resident is a part of domestic factor income of India, because the company is generating profit within the domestic territory of India. But these profits are a part of income from domestic product accruing to rest of the world Therefore, these are not reflected in the estimation of national income. These are deducted from domestic income to find national income.]

4. Why is the income earned by foreigners working in a branch of a foreign bank in India a part of the domestic factor income of India?

Ans. This is because the foreign bank is located within the domestic territory of India. Domestic factor income includes all factor incomes generated within the domestic territory of a country.

5. Production of defence goods is a limitation of GDP as an index of social welfare. How?

Ans. Production of defence goods is a limitation of GDP as an index of social welfare. Because, defence goods do not make any direct contribution to the welfare of the individuals and households of a country.

DOWNLOAD MOBILE APPLICATION TO LEARN MORE: NATIONAL INCOME AND RELATED AGGREGATES FOR CLASS 12

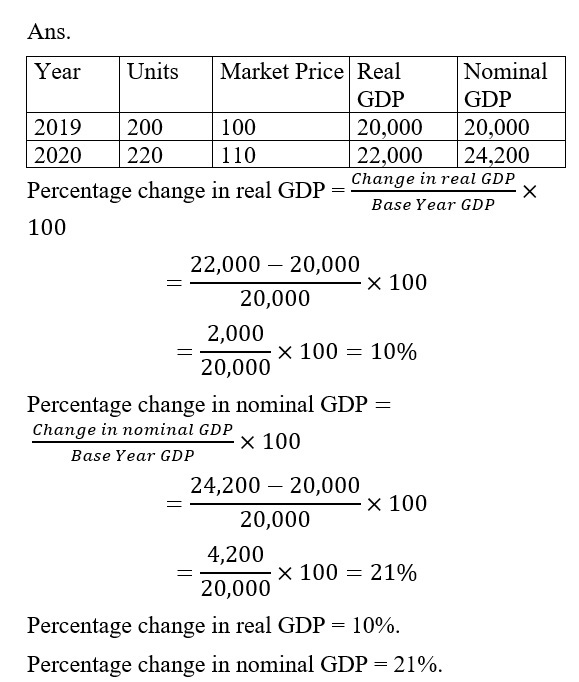

6. Only one product D is produced in the country. Its output during the year 2019 and 2020 was 200 and 220 units respectively. The market price of the product during the year was Rs.100 and Rs.110 per unit respectively. Calculate the percentage change in real GDP and nominal GDP in year 2020 using 2019 as the base year.

DOWNLOAD MOBILE APPLICATION TO LEARN MORE: NATIONAL INCOME AND RELATED AGGREGATES FOR CLASS 12

8. Should the following be treated as normal resident of India? Give reason for your answer

(i) Foreigner working in Indian embassy in Taiwan.

(ii) Indian working in Asian Development Bank in Phillipines.

(iii) Indian student in USA who has been living there for five years

Ans. (i) Foreigner working in Indian embassy in Taiwatres not a normal resident of India.

Reason: (a) He is not normally residing in India, and (b) His centre of interest does not lie in India.

(ii) Indians working in Asian Development Bank in Phillipines is a normal resident of India.

Reason: His centre of interest lies in India.

(iii) Indian student in USA who has been living there for five years is a normal resident of India.

Reason: His centre of interest lies in India. Also, as a rule of thumb, students studying abroad (no matter for how long) are treated as normal residents of the country they belong to.

DOWNLOAD MOBILE APPLICATION TO LEARN MORE: NATIONAL INCOME AND RELATED AGGREGATES FOR CLASS 12

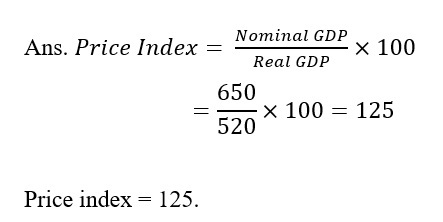

7. If the Real GDP is Rs. 520 and Nominal GDP is Rs. 650, calculate the price index (base = 100).

9. An ambassador in US embassy in India stays in his job for a period exceeding one year. Would he be treated as a resident or non-resident of India? Give reason.

Ans. Resident of a country is defined as a person who normally resides in the country for does not leave the country for a period exceeding one year) and whose centre of interest lies in the country concerned. However, there are certain rules of thumb in national income accounting (based on standard practices rather than any logic). One such rule of thumb is that the foreign diplomats like ambassadors continue to be treated as non-residents even if their stay exceeds one year Moreover, centre of interest of such diplomats continues to be in the country they belong to Accordingly, US ambassador in India would be treated as non-resident of India, even when his stay in India exceeds the period of one year.

DOWNLOAD MOBILE APPLICATION TO LEARN MORE: NATIONAL INCOME AND RELATED AGGREGATES FOR CLASS 12

10. The government has withdrawn subsidy on petrol in the domestic market. But petrol is now selling cheaper than before.

Do you think the withdrawal of subsidy has led to a rise in real income of the people in India? Frame your answer in the context of price of petrol in the international market.

Ans. Other things remaining constant, withdrawal of subsidy should lead to a rise in market price of the commodity. Implying a fall in real income of the people. However, petrol is a distinct case. The bulk of domestic supply of petrol is met through imports. The price of petrol in the international market has so significantly reduced that, even after withdrawal of subsidy in the domestic market, petrol is available to the people at a rate cheaper than before. Thus, real income of the people has risen not because of withdrawal of subsidy, but because of a substantial fall in price of petrol in the international market, leading to a fall in price in the domestic market.

4. Analysis & Evaluation

1. The Government of India has launched a scheme of cash transfers to the people below poverty line. Would you consider these transfers as a part of domestic income of the country?

Ans. No, because these are just transfer payments, not related to factor services rendered by the beneficiaries.

2. Do you think higher level of real GDP always leads to higher availability of goods per person in the domestic economy? If not, what lesson do you draw from such a situation?

Ans. No Higher level of real GDP may not always lead to higher availability of goods per person in the domestic economy. It depends on the growth rate of population in case growth rate of population is very high, the availability of goods per person may not increase. It may in fact decrease over time in case population grows faster than the GDP.

A situation when population grows faster than GDP Land per capita availability of goods declines) suggests that the GDP growth would become effective only when population growth is curbed (checked). We must devise a policy of Birth Control Only then a rise in GDP would lead to a rise in quality of life of the people.

3. Does increase in domestic income always lead to increase in national income? If not, give an illustration in support of your answer. Also, write two suggestions to accelerate the growth of domestic income.

DOWNLOAD MOBILE APPLICATION TO LEARN MORE: NATIONAL INCOME AND RELATED AGGREGATES FOR CLASS 12

Ans. No Increase in domestic income may not always lead to increase in national income

Illustration:

National Income Domestic Income Net factor income from abroad

Let us assume that domestic income increases from Rs.160 crore to Rs.200 crore. But net factor income from abroad decreases from Rs.60 crore to Rs.15 crore. Thus, domestic income increases by Rs. 40 crores (Rs. 200 crore – Rs.160crore = Rs. 40 crore). But net factor income from abroad decreases by Rs. 45 crore (Rs. 15 core – Rs. 60 crore = (-) Rs. 45 crores]. So that, the sum total of domestic income and net factor income from abroad decreases by Rs. 5 crore [Rs. 40 crore – Rs. 45 crore = (-) Rs. 5 core]. This leads to a fall in national income by Rs. 5 crore.

Suggestions:

(i) The government must make substantial investment in infrastructural development. This is expected to induce domestic investment across all production activities. Accordingly, growth of domestic income will accelerate.

(ii) The government should remove red-tapism (administrative-hurdles), and promptly grant green clearances (clearances related to environment) for FDI (Foreign Direct Investment). If FDI picks up, growth of domestic income will accelerate.

4. The government claims that demonetisation of 500- and 1,000-rupee notes will lead to GDP growth Do you agree?

Ans. Demonetisation will shrink the shadow economy (black money economy). Unaccounted GDP would now become accounted GDP Accordingly, GDP growth would look to be higher than before, even when real output in the economy remains the same.

DOWNLOAD MOBILE APPLICATION TO LEARN MORE: NATIONAL INCOME AND RELATED AGGREGATES FOR CLASS 12

ALSO VISIT: DEFINITION OF ECONOMICS CLASS 11 ISC NOTES

BASIC CONCEPTS OF MACROECONOMICS CLASS 12

DOWNLOAD MOBILE APPLICATION TO LEARN MORE: NATIONAL INCOME AND RELATED AGGREGATES FOR CLASS 12