ALSO VISIT : SECTORS OF INDIAN ECONOMY FOR MRSAFPI

DOWNLOAD MOBILE APPLICATION TO LEARN MORE: MCQ’s ON MONEY AND CREDIT

Money and Credit topic is part of Social Science portion of MRSAFPI (Maharaja Ranjit Singh Armed Forces Preparatory Institute) Examination. This is the new section introduced in the year 2021-22 by the Maharaja Ranjit Singh Academy as a part of entrance exam for the NDA (National Defence Academy). In this post, you will study about the Sectors of Indian Economy topic and the Multiple-Choice Questions for the Maharaja Ranjit Singh Armed Forces Preparatory Institute Examination.

MONEY

Money refers to anything that is generally accepted in payment for goods or services or in the repayment of debts.

Money is a stock concept. It is a certain amount at a given point in time.

Money is distinct from wealth or income.

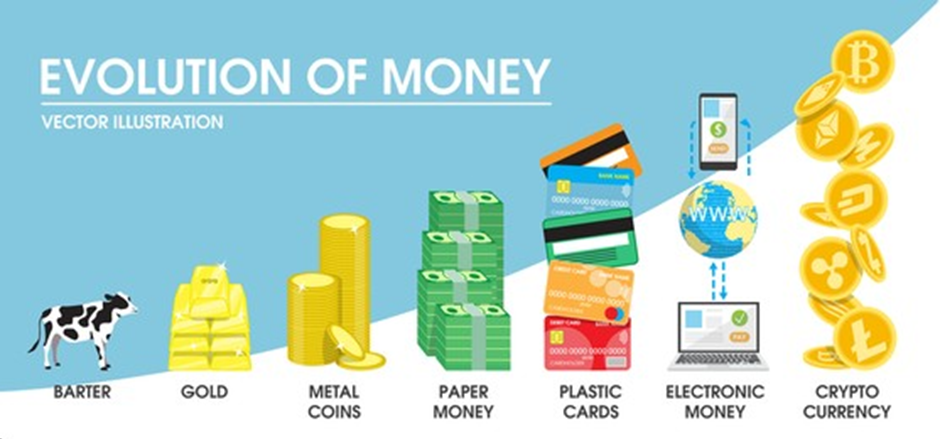

BARTER SYSTEM

Barter system is the trading of products and services from other products, services.

Barter trading is the simple method of transaction, in which no money is used.

Barter system was used in ancient times for the exchange goods. It was a system where one commodity, product or some goods was exchanged for another. For instance, if a person has 1 kg of sugar and he wants to have 1 kg of jaggery in exchange for that, he can exchange the same if there is someone who is willing to exchange jaggery for sugar. This process was called a commodity for commodity exchange. Further, it was replaced by the monetary system.

Drawbacks of Barter System

- In a large economy, Barter exchanges are not feasible.

- Under the barter system, it is not feasible to carry forward one’s wealth.

- In a search for a person to exchange their surplus, in a barter system, a person would end up incurring very high costs.

- Taking into consideration the same example of rice, these are perishable goods, one cannot save it like money, moreover money is not perishable.

- For example, if a person is looking to barter surplus rice, then a lot of resources and time would be spent on finding the person who would be willing to exchange goods that you need.

- Moreover storing rice also would require a lot of space, if there are space constraints then it would be a problem.

DOUBLE COINCIDENCE OF WANTS

It occurs when both parties agree to sell and buy each other’s commodities at the same time in the trade. Double coincidence of wants is a key element of the barter system.

MODERN FORMS OF MONEY

DOWNLOAD MOBILE APPLICATION TO LEARN MORE: MCQ’s ON MONEY AND CREDIT

Currency: The Reserve Bank of India, on behalf of the Indian government, issues currency notes. No other person or organization is permitted to print money. In India, the rupee is generally recognized as a medium of exchange.

Deposit in Banks: People might also keep their money in the form of bank deposits. People put their surplus money in the bank by opening a bank account in their own name. Banks not only accept deposits, but they also pay interest on them. Deposits in bank accounts that can be withdrawn on demand are referred to as demand deposits. Cheques are used instead of cash to make payments.

Cheques: It’s a piece of paper that instructs the bank to transfer a specified amount from a person’s account to the person named on the check.

DOWNLOAD MOBILE APPLICATION TO LEARN MORE: MCQ’s ON MONEY AND CREDIT

LOAN ACTIVITIES OF BANKS

Loan Activities of Banks

- Banks only hold a small amount of their deposits in cash on hand. In India, banks now maintain approximately 15% of their deposits in cash. This is retained as a reserve to pay depositors who may come to the bank on any given day to withdraw money.

- The majority of deposits are used to extend loans by banks. Loans for numerous economic activities are in high demand. On loans, banks charge a greater interest rate than they do on deposits.

- Banks’ major source of income is the difference between what they charge borrowers and what they pay depositors.

TWO DIFFERENT CREDIT SITUATIONS

A credit (loan) arrangement is one in which the lender provides money, products, or services to the borrower in exchange for the promise of future payment.

i. In the first scenario, a person borrows money for production purposes with the promise of repaying the loan at the end of the year when the work is accomplished. And by the end of the year, he or she has made a big profit from manufacturing operations and is able to repay the loan. As a result, the person is in a better position than previously.

ii. In the second scenario, a person borrows money for production purposes with the promise of repaying the loan at the end of the year, when the production job is accomplished. And by the end of the year, he or she has fallen into a financial trap. As a result, that person is in a worse situation than before.

TERMS OF CREDIT

Every loan agreement stipulates an interest rate that must be paid to the lender in addition to the principal repayment. Lenders also want collateral (security) in exchange for loans.

1. Collateral is an asset that a borrower holds, such as land, a building, a vehicle, livestock, or bank savings, that the borrower uses as a guarantee to a lender until the loan is returned. If the borrower fails to repay the loan, the lender has the authority to sell the asset or collateral to recover payment.

2. The terms of credit include the interest rate, collateral and documentation requirements, as well as the form of repayment. It varies depending on the lender’s and borrower’s personalities.

DOWNLOAD MOBILE APPLICATION TO LEARN MORE: MCQ’s ON MONEY AND CREDIT

FORMAL SECTOR CREDIT IN INDIA

1. Formal Sector Loans: Loans from the formal sector include those from banks and cooperatives. The Reserve Bank of India (RBI) is in charge of overseeing the operation of formal loan sources. Banks must report to the RBI how much they are lending, to whom, and at what interest rate, among other things.

2. Informal Sector Loans: Loans from the informal sector include those from moneylenders, traders, employers, family, and friends, among others. There is no regulatory body that oversees the lending activities of informal lenders. There is no one to stop them from obtaining their money by unethical means.

Formal Credit: The RBI oversees the operation of formal sources of loans, which includes banks and cooperatives. To ensure that the bank maintains a minimum cash balance and that loans are given not just to profit-making businesses and dealers, but also to small growers, small scale industries, small borrowers, and so on. Banks are required to report their actions to the RBI on a regular basis.

Informal Credit: Money lenders, traders, employers, relatives, and friends are just a few examples. There is no one in charge of monitoring their credit operations. They can charge any interest rate they want. There is no one to stop them from obtaining their money by unethical means.

DOWNLOAD MOBILE APPLICATION TO LEARN MORE: MCQ’s ON MONEY AND CREDIT

SELF-HELP GROUPS

A self-help group is a village based financial committee usually composed of 10-20 local women or men. SHG’s are innovative organisational setup in India for the women welfare. Self help group have been able to activate small savings either on weekly or monthly basis.

Self help groups also known as mutual help or support groups are the support groups of people who provide mutual support for each other.

SELF HELP GROUPS TO POOR PEOPLE

Poor households continue to rely on informal sources of financing for the following reasons:

- In rural India, banks are not widely available.

- Even if banks are present, obtaining a bank loan is substantially more difficult because adequate documentation and collateral are required.

Self-Help Groups were formed to address these issues (SHGs). SHGs are small groups of poor people who encourage their members to save small amounts of money.

ADVANTAGES OF SELF HELP GROUPS

- It assists borrowers in overcoming the lack of collateral issues.

- SHGs are the foundations of the rural poor’s organisation.

- People can receive loans on schedule and at a fair interest rate for a number of objectives.

- It assists women in becoming financially self-sufficient.

- The group’s frequent meetings give a forum for discussing and taking action on a variety of social concerns such as health, nutrition, domestic violence, and so on.

DOWNLOAD MOBILE APPLICATION TO LEARN MORE: MCQ’s ON MONEY AND CREDIT

Table of Contents

MCQ’s ON MONEY AND CREDIT

- In barter system goods are exchanged with…………….

A. Money

B. Goods

C. Clothes

D. Shoes

Answer: B

2.Currency includes

A. Paper Notes

B. Coins

C. Both (A) and (B)

D. None of these

Answer: A

3.Which of the following forms of money are closely linked to the working of the modern banking system?

A. Currency and deposits

B.Notes and coins

C. Barter system

D. Current accounts

Answer: C

4.Where do the banks use the major portion of the deposited money?

A. To buy shares

B.To invest in the companies

C. To extend loans

D. To give cash to the account holders

Answer: C

5.Banks charge……….. on loans than what they offer on deposits.

A. A lower interest rate

B. A higher interest rate

C. An equal interest rate

D. Either lower or equal interest rate

Answer: B

6.Credit refers to a situation where the lender supplies the borrower with………….

A. Money

B. Goods

C. Services

D. All of these

Answer: C

7. What is the main reason for the farmers to borrow loans in the rural areas?

A. Crop production

B. To buy food and clothes

C. Education of children

D. To repay the loan

Answer: A

8.The utility of credit depends on which of these factors?

A. Risks in the situation

B. Some other support in the case of less

C. Favourable Climate

D. Only (i) and (ii)

Answer: D

9.Which of the following are the terms of credit except?

A. Interest rate

B. Collateral

C. Documents

D. Profession of the borrower.

Answer: D

10.How does the trader ensure that the money given to the farmers as loans is repaid?

A. He makes the farmers to sell the crop to him.

B. He threatens the farmers.

C. He sells the lands to the farmers.

D. He takes the help of the court.

Answer: A

ALSO VISIT : SECTORS OF INDIAN ECONOMY FOR MRSAFPI

DOWNLOAD MOBILE APPLICATION TO LEARN MORE: MCQ’s ON MONEY AND CREDIT